Understanding the Emotional Side of Debt

The Silent Weight We All Carry

Debt is rarely just about numbers.

It’s about the feeling that something is quietly pressing on your chest even when you’re smiling, working, or scrolling through your phone late at night. It’s that flicker of unease when a payment reminder pings, the small jolt in your stomach when you check your balance and see more red than black.

In truth, debt doesn’t just live in your financial statements it lives in your nervous system.

And you’re not alone.

Across India, millions of middle-class professionals from young graduates to working parents carry invisible financial tension. The numbers might differ, but the emotional equation is eerily similar:

the sense that you’re constantly catching up, never arriving.

Maybe it’s your credit card bill hovering around ₹1,20,000, or a personal loan you took during tough months that never seems to shrink.

Maybe you’ve been paying EMIs regularly, but the total still feels stubbornly the same.

Debt feels heavy not because of the interest rate but because of the interest it takes on our peace.

Why Debt Feels So Deeply Personal

Let’s pause and ask why does owing money affect us so much more than, say, paying rent or utility bills?

Both are expenses, right?

Not quite.

Rent is a transaction it begins and ends.

Debt is a relationship.

A quiet, persistent one with the past.

Every EMI is a reminder of a decision once made sometimes wisely, sometimes out of necessity, and sometimes, if we’re honest, out of impulse or fear.

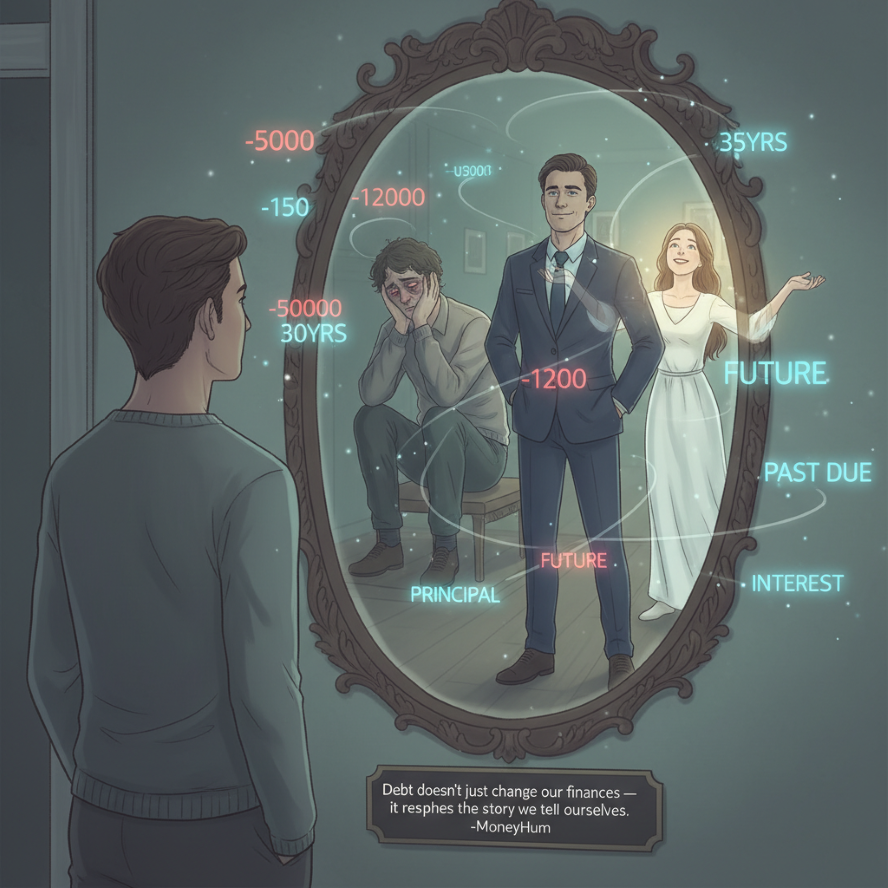

And that’s what makes it emotionally complicated: debt connects our past selves (who borrowed) with our present selves (who repay) while our future selves wait for freedom.

When those three selves aren’t aligned, we feel friction.

Regret whispers from the past, guilt lingers in the present, and anxiety clouds the future.

But here’s the truth most financial advice misses:

you don’t break free from debt by fighting it; you break free by understanding it.

The Emotional Cycle of Debt

There’s a rhythm to debt not just financially, but emotionally.

If you’ve ever felt trapped in a loop, it might sound familiar:

- The Trigger: An unexpected expense, an emotional purchase, or the slow creep of lifestyle inflation.

- The Relief: The quick dopamine hit of solving an immediate problem “I’ll handle it later.”

- The Denial: You promise yourself it’s temporary. You avoid checking the exact total.

- The Shame: The moment you do check, the number feels bigger than expected.

- The Rationalization: “Everyone has EMIs,” you say, “it’s normal.”

- The Burnout: Eventually, even making payments feels like running on a treadmill.

This is what psychologists call “reward anticipation bias.”

Our brain overvalues immediate comfort and undervalues long-term peace.

It’s why repaying debt feels harder than it looks on paper because emotionally, it’s not just about paying money back. It’s about forgiving the version of you who borrowed it.

Debt as a Mirror

What if we looked at debt not as a punishment, but as a mirror?

Each loan, each credit balance reflects something deeper a season of your life.

The student loan might reflect ambition.

The credit card debt might reflect generosity or the desire to keep up appearances.

The home loan reflects hope the belief that your future self deserves stability.

And within each, there’s wisdom.

You didn’t borrow because you were weak. You borrowed because, at that moment, you were trying to protect or uplift yourself.

Debt becomes toxic only when we lose the story behind it.

The Hidden Layer: Cultural Weight of Debt in India

In many Indian households, debt isn’t just financial it’s moral.

From childhood, many of us grow up hearing, “Never borrow it’s a matter of family pride.”

Yet as adults, we find ourselves navigating a world where credit is the currency of growth.

So, when we fall into debt, the emotion isn’t just guilt it’s shame.

We feel as though we’ve violated a deeper rule.

This cultural layer often leads to secrecy hiding credit card statements from partners, avoiding money conversations with parents, pretending things are fine.

But here’s the irony silence amplifies the burden.

As explored in (Financial Anxiety Is the Modern Disease: How to Heal Money Fear & Stress), the cure begins when you talk about it when debt stops being a secret, and starts being a story of self-awareness.

The Psychology of Avoidance

Have you noticed how we often avoid opening loan apps or checking exact balances?

That’s not laziness that’s our brain’s way of managing discomfort.

When faced with painful information, the mind protects itself by avoiding it.

Psychologists call this “cognitive dissonance” the stress of holding two conflicting truths:

“I know I should face this,” and “I can’t bear to face this right now.”

But what’s fascinating is once we do look, once we write the numbers down, the fear starts shrinking.

Clarity is a calm maker.

Money, like emotion, grows calmer when acknowledged.

Guilt, Shame, and Self-Worth

Many readers quietly admit this truth:

“It’s not the money I owe that hurts it’s the way I feel about myself because of it.”

Debt can sometimes whisper harsh stories in our minds:

“You’re careless.”

“You’re behind everyone else.”

“You’ll never get out of this.”

But these stories are not truth they’re temporary noise created by comparison and exhaustion.

If you’ve ever felt that way, remember self-worth doesn’t fluctuate with your account balance.

You are not your debt.

You are the awareness that can transform it.

And every time you make a payment even ₹500 you’re not just repaying money.

You’re reclaiming control, piece by piece, from that old voice.

Why Some People Repay Faster (and Stay Free)

There’s a fascinating pattern psychologists have observed people who successfully get out of debt share one emotional trait:

They fall in love with progress.

Not perfection. Not big leaps.

Just progress.

They track small wins.

They celebrate one EMI cleared.

They talk kindly to themselves when they slip.

In contrast, those who give up often see debt repayment as punishment something to “endure.”

The difference isn’t income or intelligence it’s relationship.

When you start treating debt repayment as an act of self-respect, not self-punishment, your energy shifts.

And from that shift comes momentum.

The Moment of Awakening

There’s always a moment a quiet one when you decide,

“I’m done carrying this weight.”

Not from anger, but from exhausted clarity.

You don’t need a motivational quote or a financial seminar.

You just need that small internal click when you realize your peace matters more than your past.

That’s the doorway to the next chapter where clarity meets calculation.

Because while emotions shape our relationship with debt, math decides the path out.

How Debt Shapes Behavior and Identity

Debt Changes How We See Ourselves

Debt doesn’t just live in spreadsheets it lives in our sense of self.

It changes how we walk through the world.

Have you ever noticed how even when no one else knows about your debt, it still feels like everyone can see it?

Like a quiet background hum in every conversation about money:

when friends discuss vacations, investments, or new phones you hesitate.

You say, “Maybe later.”

Debt silently alters your posture toward life.

It creates a subtle distance between who you are and who you want to be.

Not because you are incapable.

But because debt gently trains your brain to think in defensive mode to always calculate, conserve, and avoid risk.

The psychology behind this is simple:

when the mind perceives a “threat” (in this case, owing money), it begins to prioritize safety over growth.

We stop thinking expansively.

We start thinking survivally.

That’s why, for many people, even after becoming debt-free, the emotional pattern lingers.

They still hesitate to invest, or to take opportunities, because the memory of scarcity remains imprinted.

So, the journey out of debt isn’t just about repaying loans:

it’s about reprogramming how you relate to uncertainty, freedom, and self-trust.

The “Debt Identity” and How It Sneaks In

When something persists long enough in your life, it starts to form part of your identity.

This is called “learned association.”

If you’ve been in debt for years even if you manage it responsibly your brain starts to weave it into your self-concept:

“I’m the kind of person who always has EMIs.”

“I’m just not good with money.”

“Freedom is for people with higher salaries.”

These are not facts. They’re repetitive beliefs hardened by emotional fatigue.

The problem is the longer we hold onto these beliefs, the harder it becomes to imagine life without them.

We start budgeting around debt instead of budgeting for freedom.

But here’s something powerful:

beliefs are learned and anything learned can be unlearned.

In (Why You Keep Chasing Quick Profits), we explored how instant gratification shapes investing habits.

Debt works the same way it trains us to prefer emotional relief (“I’ll deal with it later”) over numerical progress (“Let me calculate and plan”).

The key to breaking free begins not with a new spreadsheet but with a new story about who you are.

From Borrower to Builder: Shifting the Internal Story

When you call yourself a borrower, the world looks different.

Every paycheck feels pre-assigned. Every rupee is already spoken for.

But when you shift your language even slightly from “I owe” to “I’m rebuilding,” something powerful happens.

You stop being the victim of the past and start being the architect of your future.

Behavioral scientists often say:

“Language doesn’t just describe reality it creates it.”

Start small.

When you talk to yourself about money, use builder language:

- Instead of “I’m stuck paying off my credit card,” say “I’m creating space for freedom.”

- Instead of “I’m terrible with savings,” say “I’m learning how to prioritize peace.”

This isn’t toxic positivity it’s neurological reframing.

Your brain literally begins to form new associations.

And when your internal story changes, your external actions soon follow.

How Debt Affects Motivation

There’s an irony about debt:

The more you owe, the harder it is to feel motivated to repay.

Why? Because overwhelm kills action.

Imagine someone with ₹3,00,000 of credit card debt at 18% interest, another ₹2,00,000 personal loan at 12%, and a car loan of ₹5,00,000.

The total ₹10,00,000 feels massive.

When faced with a number that big, your brain experiences decision fatigue.

It whispers, “What’s the point? My ₹5,000 payment won’t change anything.”

And that emotional resignation leads to procrastination.

This is why the Debt Snowball method (which we’ll explore soon) works so well for some people it uses psychology, not math, to break paralysis.

It says: “Forget the total. Focus on one small win.”

The idea is simple but profound momentum matters more than magnitude.

Every cleared balance, no matter how small, sends a message to your subconscious:

“I can do this.”

And that single belief when felt consistently becomes the engine of transformation.

When Debt Shapes Relationships

Money doesn’t exist in isolation it flows through our relationships.

Debt, too, seeps into conversations, habits, and even intimacy.

Sometimes, not through fights or visible tension, but through quiet withdrawal.

One partner avoids discussing finances; the other starts managing silently.

One hides bills; the other senses something’s off but doesn’t ask.

Debt introduces emotional asymmetry one person carries invisible worry, the other feels unseen.

It’s not about mistrust; it’s about emotional protection.

No one wants to disappoint the people they love.

But here’s the paradox financial avoidance born out of love often leads to emotional distance.

Couples who manage to heal their money communication patterns tend to find not just financial peace, but emotional intimacy.

Because when you can be transparent about your fears, your numbers, and your plans you build trust through truth.

So if you’re in a relationship, think of debt repayment not as an individual journey, but a shared one.

Let vulnerability replace secrecy not with guilt, but with partnership.

Cultural Scripts and Debt Behavior

In India, the cultural narrative around debt is layered.

For generations, the idea of borrowing was associated with failure.

Our grandparents believed in cash-first living “Never take on a loan you can’t repay immediately.”

But in modern urban India, that narrative is shifting.

Credit has become not just accessible, but aspirational.

“Zero-cost EMI,” “Buy Now, Pay Later,” and “Instant Approval Loans” these phrases no longer feel like debt; they feel like convenience.

Yet emotionally, the body knows the truth.

Behind every “later,” there’s a small echo of anxiety the unspoken cost of tomorrow’s comfort.

This duality between cultural pride in being debt-free and the modern lure of instant gratification creates confusion.

It’s why many people oscillate between extremes:

- Overspending one month

- Overcorrecting with austerity the next

The emotional whiplash is exhausting.

But here’s the insight:

Debt isn’t moral it’s mechanical.

It’s not a reflection of character, but of circumstance and choice.

When you stop seeing it as a shameful mistake and start seeing it as a solvable equation, you regain clarity.

The journey out becomes a skill not a confession.

The Confidence Cost of Debt

Debt doesn’t just cost interest it costs confidence.

Many professionals admit they feel hesitant asking for promotions, switching jobs, or taking entrepreneurial risks while in debt.

Why? Because debt creates psychological dependency.

It binds your choices to the safety of a monthly paycheck.

But here’s the twist: that same pressure can also be transformed into purpose.

When you channel the energy of “I must survive” into “I will simplify,” something shifts.

You start cutting unnecessary noise fewer distractions, fewer impulses, more focus.

Debt can, paradoxically, teach discipline if approached consciously.

It’s not the debt that defines you; it’s the awareness it awakens.

As explored in (Your Financial System Needs a Dashboard — Not Just Dreams), awareness gives you control dashboards calm chaos.

So before we even get into which debt repayment method to choose, it’s essential to do this emotional audit:

“What kind of person am I when I owe money?”

“Do I avoid, overthink, or overwork?”

“What am I actually craving freedom, security, or relief?”

Your answers will tell you which repayment path (Snowball or Avalanche) fits your emotional operating system.

From Fear to Framework

Before moving to the next chapter, let’s summarize what we’ve learned so far:

- Debt reshapes identity but that identity can be rewritten.

- Overwhelm reduces motivation small wins rebuild it.

- Silence amplifies shame open conversations dissolve it.

- Cultural conditioning confuses behavior awareness restores balance.

- Debt isn’t moral it’s mechanical and once treated like a system, it becomes solvable.

The Mathematics of Freedom: Understanding Snowball vs Avalanche

The Calm in Knowing the Numbers

Before we dive into methods, let’s remember something profound:

numbers, unlike emotions, don’t lie and they don’t judge.

Debt feels overwhelming not because of the math, but because of the meaning we attach to it.

When you finally see the numbers in full light, without shame, what once felt infinite suddenly becomes finite.

A list replaces a fog. A plan replaces panic.

The calm begins here not with money, but with measurement.

Let’s imagine a typical Indian professional’s situation:

| Debt Type | Amount (₹) | Interest Rate (p.a.) | Minimum EMI (₹) |

|---|---|---|---|

| Credit Card | 3,00,000 | 18% | 9,000 |

| Personal Loan | 2,50,000 | 12% | 7,500 |

| Car Loan | 5,00,000 | 9% | 10,000 |

| Total Debt | 10,50,000 | — | 26,500/month |

For many, this table feels familiar maybe the numbers differ, but the pressure feels the same:

multiple payments, different due dates, and an endless loop of “just enough to get by.”

So how do you break the loop?

You use structure.

There are two classic systems of accelerating debt repayment:

the Snowball and the Avalanche.

Both are mathematically sound.

But the real power lies not in which is better on paper, but in which is better for you.

Let’s explore both not as mere techniques, but as mindsets.

Method 1: The Debt Snowball Momentum over Math

The Snowball Method is simple:

you pay off your smallest debts first, regardless of their interest rates.

How it works

- List all your debts from smallest to largest balance.

- Pay the minimum EMI on all except the smallest one.

- Pour every extra rupee into that smallest debt until it’s gone.

- Once cleared, roll that payment into the next smallest like a snowball gathering size.

Why it works psychologically

Our brains crave visible progress.

When you eliminate even one loan no matter how small you get an instant rush of clarity and control.

This is called “progress bias” the mind stays more motivated when it can see milestones achieved.

Each cleared balance sends a subtle emotional message:

“I can do this.”

And that belief compounds faster than interest.

Let’s see this with our example.

Example: The Snowball Effect in Action

| Debt Type | Balance (₹) | Interest Rate | Monthly EMI (₹) |

|---|---|---|---|

| Personal Loan | 2,50,000 | 12% | 7,500 |

| Credit Card | 3,00,000 | 18% | 9,000 |

| Car Loan | 5,00,000 | 9% | 10,000 |

You decide to focus on the personal loan first since it’s the smallest.

If you can free an extra ₹5,000 per month (perhaps from reduced discretionary spending or a small side income), you pay:

₹7,500 (regular EMI) + ₹5,000 (extra) = ₹12,500/month toward that loan.

You’ll clear it in about 20 months instead of 36 saving not just interest, but emotional fatigue.

Then, you roll that ₹12,500 into your credit card debt, adding it to the ₹9,000 minimum = ₹21,500/month.

This momentum accelerates repayment dramatically.

By the time you reach your car loan, you’re not tired you’re empowered.

Each closure releases emotional energy, reinforcing the loop of discipline.

Method 2: The Debt Avalanche Logic over Emotion

The Avalanche Method flips the approach.

You pay off debts with the highest interest rate first, regardless of their balance.

How it works

- List all debts by interest rate, highest to lowest.

- Pay the minimum EMI on all except the highest-interest debt.

- Channel every extra rupee toward that high-rate loan.

- Once cleared, move down the list.

Why it works mathematically

This method minimizes total interest paid and shortens the repayment period.

It’s the most efficient strategy but not always the most emotionally sustainable.

Because here’s the catch:

the highest-interest debt might also be the largest, meaning it can take months before you see visible progress.

And for the human mind delayed reward feels like no reward.

Let’s see how this plays out with the same example.

Example: The Avalanche in Action

| Debt Type | Balance (₹) | Interest Rate | Monthly EMI (₹) |

|---|---|---|---|

| Credit Card | 3,00,000 | 18% | 9,000 |

| Personal Loan | 2,50,000 | 12% | 7,500 |

| Car Loan | 5,00,000 | 9% | 10,000 |

Here, you’d attack the credit card first.

All extra ₹5,000 go here until cleared.

It may take 27 months to finish it off completely, compared to the 20 months in the Snowball method but your total interest saved will be significantly higher.

Over the full cycle, the Avalanche saves you ₹25,000–₹40,000 in interest (depending on rates and prepayment structures).

So the math wins.

But for many people, the motivation fails midway because results aren’t visible early.

Snowball vs Avalanche: The Emotional Equation

| Aspect | Snowball | Avalanche |

|---|---|---|

| Focus | Smallest debt first | Highest interest debt first |

| Advantage | Faster motivation, visible progress | Saves more money overall |

| Emotional Fit | For those who need quick wins | For those who value efficiency |

| Risk | Pays slightly more interest | Takes longer to feel momentum |

| Ideal For | Beginners, emotional spenders, anxious minds | Analytical thinkers, disciplined planners |

Now here’s the deeper truth:

Neither method is inherently better.

They’re just tools.

The question is: which tool suits your psychology best?

When Emotion Beats Efficiency

Let’s say you’re someone who’s struggled with motivation you often start strong but fade after a few months.

You’ve been meaning to get out of debt for years, but it always slips down the priority list.

For you, the Snowball method isn’t just a strategy it’s therapy through progress.

It rewires your brain’s reward system.

Each cleared debt releases dopamine a sense of success that sustains future effort.

As momentum builds, you naturally develop the discipline the Avalanche method demands but from a gentler starting point.

On the other hand, if you already track expenses, plan ahead, and find emotional satisfaction in precision the Avalanche method is your natural fit.

You’ll take comfort in the logic, knowing every rupee is working optimally.

Choosing the wrong method isn’t about intelligence it’s about misaligned energy.

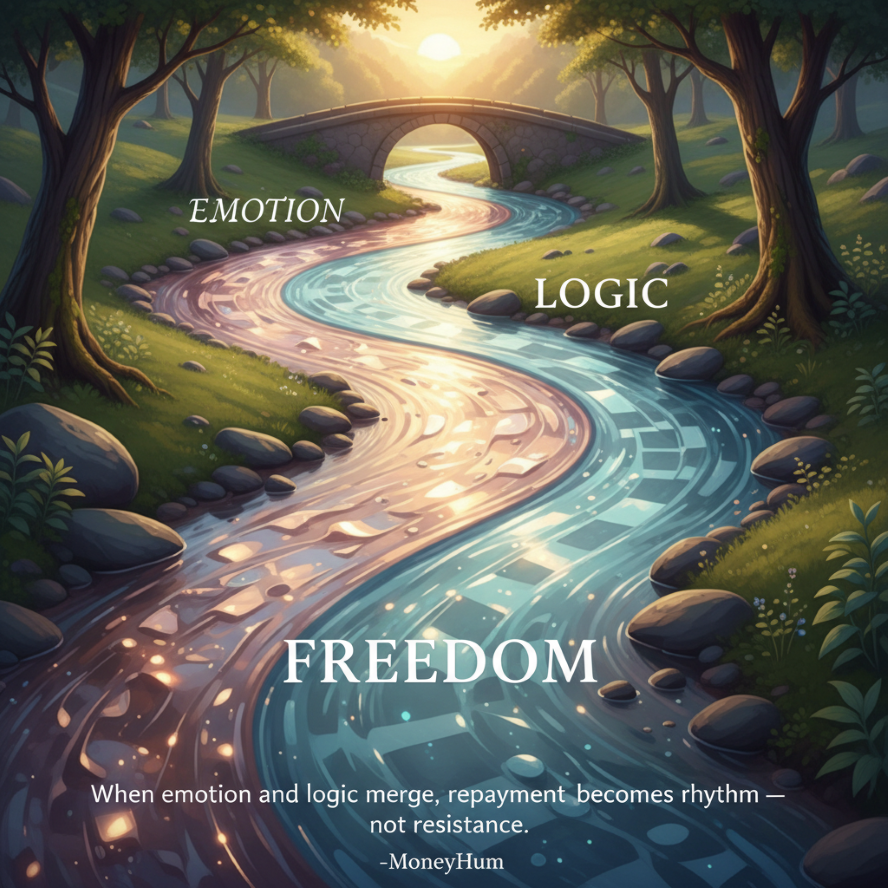

That’s why the best strategy is often a hybrid.

The Hybrid Path: Emotional Progress Meets Mathematical Sense

The Hybrid Method begins with emotion and ends with logic.

You start with one or two smallest debts using the Snowball to build rhythm and confidence.

Once momentum stabilizes, you shift to Avalanche for maximum efficiency.

This blend creates a balance of both:

- Early emotional wins (Snowball)

- Long-term savings (Avalanche)

In practice, it might look like this:

- Months 1–10: Focus on small personal loan clear it fast.

- Months 11–20: Switch focus to credit card use Avalanche logic to minimize interest.

By Month 24, you’ve paid off multiple loans and saved thousands in interest without ever losing motivation.

This method respects both human psychology and mathematical integrity the true essence of calm finance.

Automation: The Invisible Ally

Whichever method you choose, the secret to success lies in automation.

When you automate payments even partial ones you eliminate willpower from the equation.

This is crucial because motivation fluctuates, but systems don’t.

Use your bank’s standing instructions to automatically route EMIs and extra payments.

Set reminders a few days before to stay conscious, not anxious.

(As discussed in “Your Financial System Needs a Dashboard — Not Just Dreams”)

when you turn money management into a system, your mind finds peace in predictability.

Automation transforms discipline into default.

The Breakthrough Moment: Seeing Freedom Measurable

Debt freedom isn’t abstract it’s measurable.

And once measured, it becomes manageable.

Here’s a gentle visualization:

Imagine your total debt as a mountain.

Each month you climb, not to escape, but to rise above.

At first, the slope feels endless but one day, you realize the air feels lighter, the view clearer.

And eventually, you reach the ridge where you’re no longer paying for your past.

You’re saving for your peace.

This is what makes the mathematics of debt repayment sacred:

because when you understand it, you no longer fear it.

Choosing the Right Method for You: Emotional and Mathematical Fit

Why the “Right” Method Isn’t the Same for Everyone

If personal finance had one universal truth, it would be this:

What works mathematically must also work emotionally or it won’t work at all.

You can have the most efficient repayment plan in the world, but if it doesn’t align with your personality your emotional rhythms, your mental energy, your life stage it’ll collapse under its own perfection.

That’s why, before choosing between Snowball and Avalanche, we must first understand you.

Because the true “fast track” isn’t the one with fewer months or less interest it’s the one you’ll actually stay on.

Step 1: Understand Your Debt Personality

Each of us approaches money with a unique pattern a mix of emotions, beliefs, and habits.

Psychologists call this “financial archetyping.”

Let’s identify your current debt personality type.

1. The Emotional Spender

You use money to soothe, reward, or escape stress.

You often promise to “cut back next month,” but the cycle repeats.

- Pain point: Shame and impulsivity.

- Strength: Empathy, generosity, and a desire to do better.

- Best Fit: Debt Snowball. You need early wins that create positive emotional feedback.

(Also see: Emotional Spending Psychology: Why We Buy What We Don’t Need (And How to Stop))

2. The Overthinker

You analyze every number, read multiple financial blogs, and still feel uncertain about action.

You delay decisions because you want the “perfect” plan.

- Pain point: Paralysis by analysis.

- Strength: Awareness and discipline (once in motion).

- Best Fit: Debt Avalanche. You’ll find emotional peace in numerical clarity and efficiency.

(See also: Your Financial System Needs a Dashboard — Not Just Dreams)

3. The Avoider

You dislike opening loan apps or talking about money.

You feel anxiety at the sight of bills and prefer “mental accounting” guessing instead of checking.

- Pain point: Avoidance and denial.

- Strength: Deep intuition once emotionally safe.

- Best Fit: Start with Snowball, then shift to Hybrid. You need emotional ease first simplicity builds trust, then progress sustains it.

(Related read: Financial Anxiety Is the Modern Disease: How to Heal Money Fear & Stress)

4. The Strategist

You already track EMIs, budgets, and savings.

You like logic, optimization, and control.

Debt feels like a “project” not a shame point.

- Pain point: Overdiscipline leading to burnout.

- Strength: Structure and foresight.

- Best Fit: Debt Avalanche. Your clarity is your calm lean into it, but remember to rest.

5. The Visionary

You don’t like rigid systems. You want freedom not spreadsheets.

You often say, “I’ll make more money soon” and you might actually be right.

- Pain point: Overconfidence and delayed accountability.

- Strength: Optimism and creative problem-solving.

- Best Fit: Hybrid Method. Use Snowball’s momentum to start, then Avalanche’s logic to finish strong.

(Also linked to: The Path to Real Wealth: Why Patience and Compounding Beat Shortcuts)

Step 2: The Debt Personality Matrix

Here’s a simple self-assessment tool to guide your method choice:

| Trait | Low Emotional Tolerance (needs motivation) | High Emotional Tolerance (can delay gratification) |

|---|---|---|

| Prefers visible progress | Snowball | Hybrid |

| Prefers numerical optimization | Hybrid | Avalanche |

| Feels anxious about multiple loans | Snowball | Snowball → Avalanche transition |

| Comfortable with long-term focus | Hybrid | Avalanche |

| Struggles with discipline | Snowball | Hybrid |

| Feels inspired by systems | Hybrid | Avalanche |

There’s no “best” only alignment.

If your financial strategy feels peaceful not pressured you’ve chosen correctly.

Step 3: Emotion Meets Execution: Building Your Plan

Once you know your personality, your plan becomes simpler.

Let’s walk through how to design your own repayment roadmap, step by step.

Step 3.1 The Foundation: Know Your Exact Numbers

You can’t fix what you don’t face.

List every debt with its balance, interest rate, and minimum EMI.

Use a simple table like this:

| Loan | Balance (₹) | Interest Rate | EMI (₹) | Remaining Tenure (Months) |

|---|---|---|---|---|

| Credit Card | 2,80,000 | 18% | 8,400 | 36 |

| Personal Loan | 1,80,000 | 12% | 5,000 | 24 |

| Bike Loan | 70,000 | 9% | 3,000 | 18 |

Now total the outstanding balance and EMIs.

This is your current financial picture the mountain’s height.

Step 3.2 The Fuel: Find Your Extra Payment Power

This is your Fast-Track Accelerator.

Add up:

- Side income (if any)

- Reduced discretionary spending (e.g., OTTs, frequent eating out, unneeded subscriptions)

- Annual bonuses or tax refunds

Even ₹3,000–₹5,000/month extra can make a life-changing difference when applied strategically.

In a Snowball, that ₹5,000 creates momentum.

In an Avalanche, it creates efficiency.

Either way, it’s your freedom fuel.

Step 3.3 The Map: Apply the Right Order

Use your chosen method to decide repayment order:

- Snowball: Sort by smallest balance first.

- Avalanche: Sort by highest interest first.

- Hybrid: Clear 1–2 small debts, then switch to interest-based.

Once decided, commit to the sequence.

Write it down.

Stick it where you’ll see it.

Because visibility fuels accountability.

Step 3.4 The Compass: Track Emotional Momentum

Debt repayment isn’t a race it’s a rhythm.

Every month, note these three questions:

- How do I feel about my progress this month?

- Did I manage my emotional triggers around money?

- What small reward can I give myself for staying consistent?

These questions build emotional literacy the foundation of long-term financial wellness.

(See also: How to Measure Real Progress in Life (When Money Isn’t Enough))

The Art of Alignment: When Math and Mind Sync

Here’s a truth most financial planners overlook:

You can’t sustain what doesn’t feel right.

If your plan feels suffocating, you’ll rebel.

If it feels too easy, you’ll stagnate.

The sweet spot is stretch, not stress.

Enough challenge to feel progress.

Enough compassion to feel peace.

In behavioral finance, this is known as the “emotional efficiency curve.”

When emotional comfort and logical consistency intersect, performance becomes natural effortless.

That’s what a good debt plan should feel like:

effortful at first, effortless later.

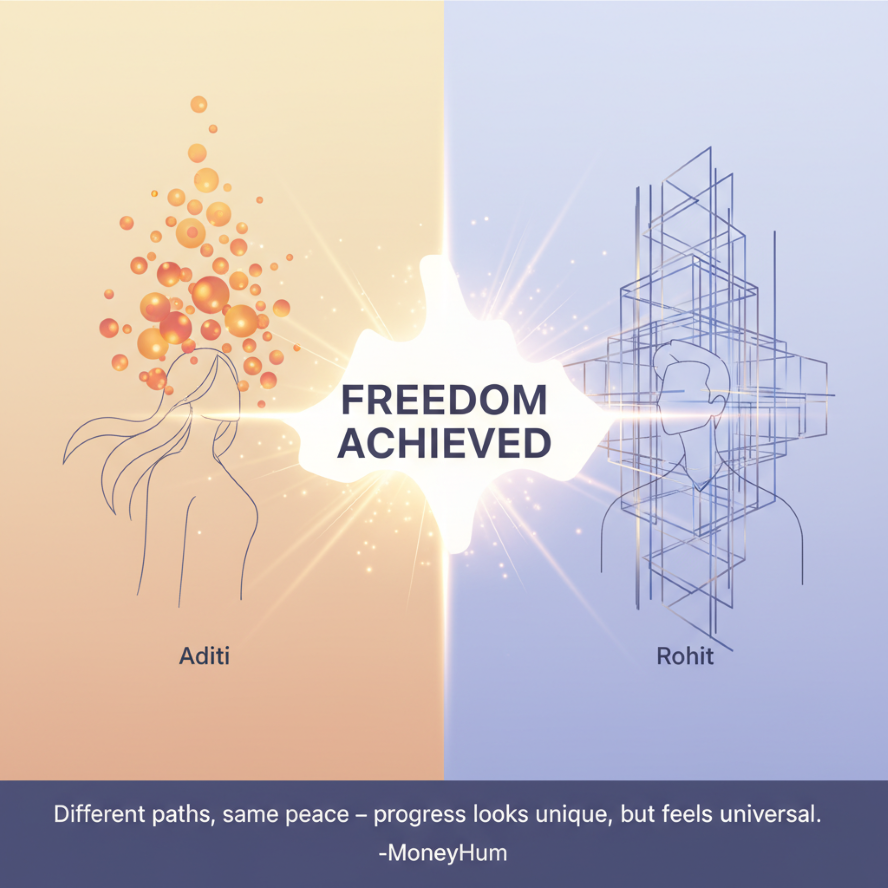

Case Study 1: Aditi’s Snowball Transformation

Aditi, 29, a marketing executive in Pune, owed:

- ₹1,20,000 credit card (18%)

- ₹70,000 furniture EMI (10%)

- ₹2,00,000 personal loan (12%)

She felt anxious and guilty. Numbers scared her.

She began with the Snowball Method, clearing the furniture EMI in 5 months with extra ₹4,000/month.

The joy of closing one account ignited her energy she tackled her credit card next.

By month 18, she was debt-free.

Her emotional takeaway:

“I stopped fearing money when I stopped avoiding it.”

Case Study 2: Rohit’s Avalanche Efficiency

Rohit, 34, an engineer from Bangalore, had:

- ₹3,00,000 credit card (18%)

- ₹2,50,000 personal loan (11%)

- ₹6,00,000 car loan (9%)

He chose Avalanche, focusing on high-interest debt first.

He automated ₹5,000 extra payments monthly and used annual bonuses to reduce principal.

By month 28, he had saved ₹42,000 in interest and cleared all loans two years early.

His reflection:

“The math gave me peace. Every EMI became a data point not a judgment.”

Step 4: Strengthen the Foundation for the Future

Once your debt is under control, don’t just stop stabilize.

The transition from debt repayment to wealth creation begins with three steps:

- Build an Emergency Fund 3 to 6 months of expenses. (Linked to: Emergency Fund Mastery: How Much You Need & Where to Keep It)

- Automate a SIP even ₹1,000/month builds forward motion. (See: Build a Strong SIP Habit: Your Simple 12-Month Plan for Beginners)

- Reflect Regularly measure progress beyond money. Emotional peace, self-trust, and reduced anxiety are real wealth.

Step 5: Forgive, Don’t Forget

The emotional closure of debt isn’t just in finishing payments it’s in forgiveness.

Forgiving the past version of yourself who borrowed, spent, or misjudged.

That person wasn’t reckless they were trying to cope.

When you release judgment, you reclaim energy the kind that fuels better choices.

Debt then stops being a scar and becomes a story a chapter in your growth, not a stain on your worth.

The Inner Journey: From Anxiety to Empowerment

When the Noise Finally Fades

There comes a moment in every debt journey when something shifts inside you.

It doesn’t happen on the day you clear your last loan.

It happens quietly months earlier the day your fear begins to lose its grip.

It’s the morning when you check your account not out of dread, but curiosity.

It’s the night when you fall asleep without mentally adding up your dues.

It’s when you realize you no longer feel chased.

Debt repayment, at its core, isn’t a financial project.

It’s a spiritual practice of facing what you once avoided of turning toward discomfort until it transforms into calm.

Because every EMI you pay isn’t just money leaving your account:

it’s energy returning to your self-respect.

From Anxiety to Awareness

Debt anxiety is not irrational it’s your body’s way of saying,

“I don’t feel safe.”

When your mind senses uncertainty about the future, it triggers survival instincts increased cortisol, racing thoughts, avoidance behavior.

That’s why financial anxiety feels so physical.

But awareness begins when you stop running from it.

As explored in (Financial Anxiety Is the Modern Disease: How to Heal Money Fear & Stress), anxiety loses its power when named, not solved.

Start by simply observing:

- What emotion surfaces when you think of money?

- Is it fear? Shame? Guilt? Or fatigue?

Naming it separates it from identity.

You are not anxious you are experiencing anxiety.

And once you see it, you can soothe it.

That’s the first sign of empowerment: clarity without panic.

The Subtle Healing Power of Consistency

Consistency is one of the most underestimated emotional healers.

Each time you pay your EMI on time, your nervous system receives a message:

“We are safe. We are capable.”

Even small payments, done consistently, build internal trust the most priceless currency of all.

This is why people who stick with their Snowball or Avalanche plans often describe the process as therapeutic.

Because in staying consistent, they rebuild something deeper than finances they rebuild self-trust.

When your actions align with your intentions long enough, your brain starts believing you again.

And that’s when healing begins.

When Freedom Becomes Simplicity

At first, you chase freedom.

But when you finally reach it, you realize freedom is not about having everything.

It’s about needing less.

You begin to enjoy simplicity not as sacrifice, but as clarity.

The fewer payments you have, the lighter your mind feels.

Your decisions simplify.

Your lifestyle quiets.

And for the first time in years, you start choosing not from fear, but from peace.

Freedom is rarely loud it’s the silence after the storm.

The Spiritual Side of Becoming Debt-Free

There’s a sacred symmetry to the debt journey:

you begin by owing money to others,

and you end by owing truth to yourself.

When the loans are cleared, something beautiful happens not outside, but within.

You no longer measure worth by possessions or status.

You start valuing peace as wealth.

This shift is profound.

Because while debt binds you to the past, freedom anchors you to the present.

You stop living in “someday.” You begin living in today.

As we wrote in (The Path to Real Wealth: Why Patience and Compounding Beat Shortcuts):

“Real wealth is calm, not constant growth.”

Debt teaches you this truth by inversion:

you understand what peace is only after you’ve felt its absence.

Letting Go of the Guilt

Many people, even after clearing their debts, carry invisible guilt.

They think of “wasted years,” “bad choices,” or “what could have been.”

But guilt doesn’t serve growth it freezes it.

It keeps you tied to an emotional version of debt long after the financial one ends.

So here’s the gentle truth:

You did the best you could with the awareness you had then.

Now, with deeper awareness, you’ll do better not because you must, but because you can.

Forgive yourself.

Gratitude is lighter to carry than guilt.

Debt as a Teacher

Debt teaches in ways success never can.

It teaches humility that control is an illusion.

It teaches discipline that small steps matter more than grand plans.

It teaches empathy you stop judging others’ financial mistakes because you’ve lived through your own.

It teaches resilience that peace can be rebuilt from pressure.

One day, you’ll look back and realize your debt wasn’t a detour.

It was a mirror that showed you what you value, what you fear, and what you’re truly capable of.

The Ripple Effect: New Habits, New Life

When people become debt-free, they don’t just gain money they gain momentum.

They save more naturally.

They spend more consciously.

They plan, but they also breathe.

It’s as if a quiet mental bandwidth suddenly frees up space for creativity, generosity, learning.

Even relationships begin to heal, because financial peace often brings emotional patience.

This is the real gift of freedom:

you stop reacting to life and start responding to it.

Practical Transition: From Debt to Growth

After the last EMI clears, your mind may feel oddly empty.

It’s important to redirect that energy consciously, or else lifestyle inflation will quietly fill the gap.

Here’s how to channel your new momentum:

- Keep the EMI Habit Alive Redirect the same amount into a SIP or recurring deposit. You’re already used to that cash outflow now let it build your future.

- Set Up a “Calm Fund” Not just an emergency fund, but a cushion for mental peace. This prevents relapse into credit card dependency.

- Create a Reward Ritual Celebrate progress meaningfully. Maybe a small trip, a gift to yourself, or even writing a thank-you note to your past self for enduring.

- Educate, Don’t Evangelize Share your journey not to preach, but to empower. Because someone else, quietly burdened, might find hope in your story.

(See also: Side Income Ideas for 2025: Earn ₹5,000 to ₹20,000 Monthly for Financial Peace)

The Deepest Shift: From Scarcity to Self-Trust

Scarcity says, “I don’t have enough.”

Debt whispers, “I made mistakes.”

Freedom replies, “I’ve learned.”

That’s the final transformation when money stops being a source of fear, and becomes a reflection of your emotional intelligence.

You begin to trust yourself again.

You make decisions slowly, with integrity.

You stop chasing “quick profits” and start nurturing patient growth.

This is what true wealth feels like not accumulation, but alignment.

As explored in (How to Measure Real Progress in Life When Money Isn’t Enough):

“Progress is no longer about numbers; it’s about inner peace catching up to your outer world.”

A Quiet Closing Thought

If you’re reading this right now still in the middle of repayment, still feeling heavy remember:

You’re not behind.

You’re becoming.

Every rupee repaid is proof of responsibility.

Every plan made is a sign of self-respect.

Every moment you choose awareness over avoidance is a step closer to freedom.

Debt doesn’t define you it refines you.

It turns confusion into clarity, and chaos into consciousness.

And when you finally emerge debt-free, you’ll realize something deeply calming:

the journey was never about escaping debt it was about discovering discipline, grace, and peace within yourself.

Summary 5 Takeaways to Anchor Peace and Progress

- Debt is not a failure it’s feedback. It shows where emotion overtook awareness, and how awareness can now restore balance.

- Choose systems that fit your psychology. Snowball for motivation, Avalanche for logic or Hybrid for harmony.

- Automation beats willpower. Systems protect you when emotions waver.

- Freedom begins before the finish line. The moment anxiety fades and clarity enters you’re already freer.

- True wealth is emotional regulation. When your financial decisions stem from calm self-trust, you’ve already arrived.

Epilogue The Mountain and the Meadow

Imagine your debt journey as a long climb.

Every payment a step. Every delay a rest. Every reflection a pause to breathe.

One day, you’ll reach the top.

You’ll look down at where you began fearful, uncertain, but determined.

And you’ll smile not because you conquered debt, but because you became someone who could.

Then you’ll walk down into the meadow lighter, calmer, aware:

ready not to escape money, but to dance with it wisely.

If you’ve read this till the end, thank you❤️

With love,

Your Dearest Friend,

Chitraansh

🔗 Continue Your Journey on MoneyHum:

- Financial Anxiety Is the Modern Disease: How to Heal Money Fear & Stress

- The Path to Real Wealth: Why Patience and Compounding Beat Shortcuts

- Emotional Spending Psychology: Why We Buy What We Don’t Need (And How to Stop)

- Your Financial System Needs a Dashboard — Not Just Dreams

- How to Measure Real Progress in Life (When Money Isn’t Enough)

- Emergency Fund Mastery: How Much You Need & Where to Keep It

- Build a Strong SIP Habit: Your Simple 12-Month Plan for Beginners

- Side Income Ideas for 2025: Earn ₹5,000 to ₹20,000 Monthly for Financial Peace