CHAPTER I

The Quiet Money Revolution: India’s New Generation Steps In

There is a quiet shift happening in India; not loud like the startup boom, not chaotic like the stock market, not glamorous like influencer culture. It is unfolding silently, inside bedrooms lit by laptop screens, inside shared apartments where every rupee matters, inside offices where “CTC” is a number and “in-hand” is a feeling.

For the first time in India’s financial history, two generations: Gen Z (18–25) and Young Professionals (26–35) are learning money without a template.

No single rulebook.

No single “safe path.”

No single definition of success.

Because of this, these two generations are redefining, on their own terms, what it means to earn, save, invest, spend, and build a life worth living.

The Financial Journey of Gen Z and Young Professionals

If you look closely, you will see a very human story beneath this shift.

Gen Z did not enter adulthood gradually. They entered during:

- a global pandemic

- a job market collapse

- a startup-fuelled dream economy

- a social media comparison culture

Young professionals, on the other hand, found themselves navigating:

- EMIs

- unstable work culture

- rising costs

- career stagnation

- pressure to “settle”

Both were forced to ask questions their parents never had to ask at 22 or 28:

- “Is my job secure?”

- “Should I start a side income?”

- “Should I invest or save?”

- “Is renting better than buying?”

- “Am I falling behind?”

Some of these emotional questions eventually become the same financial behaviors we explore later.

If financial anxiety feels familiar, you may appreciate reading our guide on how money stress builds silently in the modern world:

Related Reading:

The Emotional Landscape: Why Money Feels So Different Now

Let us begin with the core shift:

Money is no longer just survival; it is identity, freedom, and emotional security.

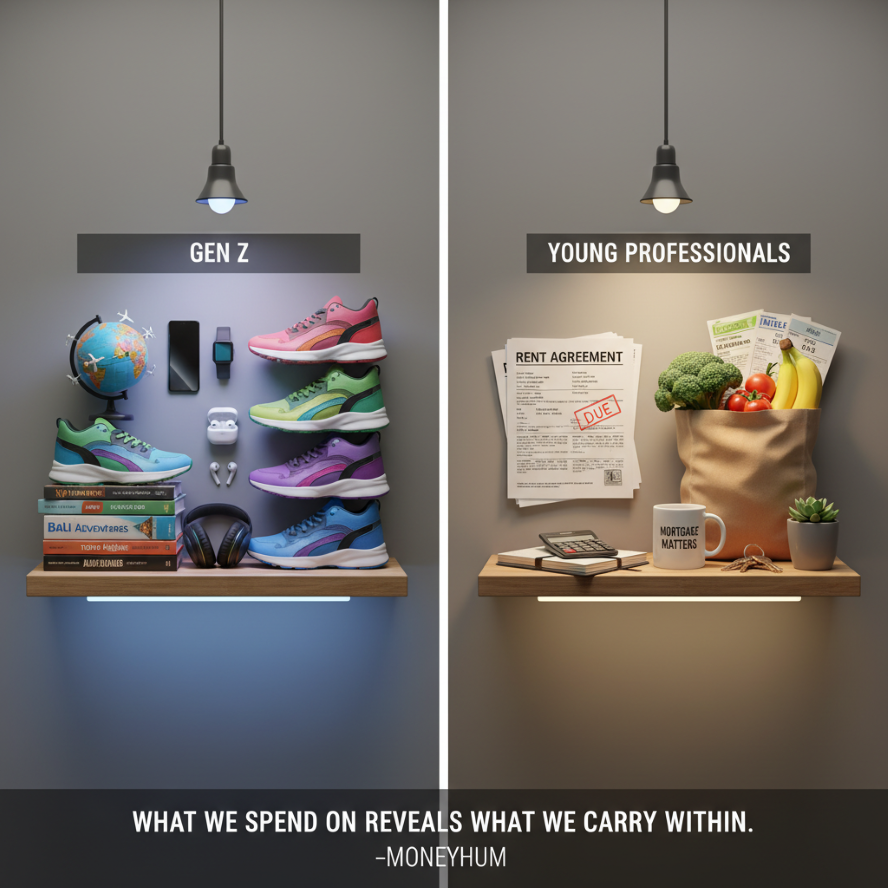

For Gen Z:

Money means independence.

Not having to ask anyone.

Not having to justify a choice.

Not having to feel small.

This is why Gen Z is curious: they experiment with crypto, digital assets, side gigs, trading, and new-age investments. They take risks early because they associate money with freedom, not “settling.”

For Young Professionals (26–35):

Money means stability.

The weight of responsibility.

The fear of slipping backward.

The race between income and inflation.

Where Gen Z feels restless, young professionals feel pressured.

Where Gen Z wants choice, young professionals crave certainty.

Both are valid, and both create completely different financial patterns which we will explore deeply in later chapters.

If you have ever felt tempted to take shortcuts because “everyone else is getting rich faster,” you may find comfort in our exploration of quick profit psychology:

The Indian Parent Effect and the New Financial Script

To understand today’s young generation, we must understand what they grew up seeing.

Most Indian households followed a simple financial system:

- Work → Earn → Save → Buy a Home → Provide for kids → Retire.

This system collapsed quietly in the last decade:

- Salaries did not grow as fast as living costs.

- House prices rose far beyond reach.

- Job security vanished.

- Social media changed how people measure success.

Young Indians realized something uncomfortable:

The old script no longer works.

So, they started writing new scripts.

This is where the financial revolution begins: not in the stock market, but in the mindset.

The Digital Shift: How the Phone Became the New Wallet, Bank, and Marketplace

UPI did not just digitize payments.

It changed how Indians think about money.

Today’s youth do not “handle” cash.

They “glance” at numbers.

- Salary → instantly spends

- Expense → instantly tracked

- Investment → instantly available

- Advice → instantly available on Reels

- Temptation → instantly available everywhere

This instant environment has reshaped financial behavior completely.

Gen Z Financial Behaviors

- micro spending

- creator economy participation

- gig work

- quick money experiments

- subscription lifestyle

Young Professional Financial Behaviors

- EMI based living

- credit card cycles

- planned investments

- fixed obligations

- long term goal planning

Both groups are guided more by flow than by “fixed budgets.”

Both feel overwhelmed by choices.

Both feel a constant pressure to “optimize.”

This constant pressure is exactly why many young Indians feel stuck in hustle exhaustion cycles. If that sounds familiar, you may appreciate:

The Loss of a Linear Life Path

Earlier generations had predictable life stages:

Study → Job → Marriage → Home → Kids → Retirement.

Today’s youth face dozens of parallel choices at once:

- Should I build a portfolio or buy a car?

- Should I switch jobs or stay stable?

- Should I travel now or save now?

- Should I invest in SIPs or index funds or stocks?

- Should I start a side hustle or upskill?

This non linear life path creates emotional turbulence.

Because choice, while empowering, is also exhausting.

Money is no longer a straight line. It is an ecosystem.

And no one prepares you for that.

The Quiet Revolution: A New Financial Identity Emerging

Despite all the challenges, something beautiful is happening.

Young Indians are quietly building a new identity with money.

- They are more aware: tracking expenses, learning finance on Instagram, seeking clarity.

- They are more independent: starting side incomes, freelancing, creating.

- They are more strategic: SIPs, index funds, emergency funds, risk appetite understanding.

- They are more self responsible: they know retirement is their responsibility.

This generation is not “worse” with money; they are simply navigating a more complex world with less guidance and more noise.

But they are doing it with remarkable resilience.

If building a steady system feels overwhelming, you may enjoy:

Related Reading:

Financial Archetypes Emerging in the New India

You will meet these personalities in almost every friend circle:

- 1. The Hustle Maxxer: Always juggling gigs, seeking “fast growth,” deeply influenced by online success stories.

- 2. The Silent Saver: Careful, consistent, conservative. Saves quietly, avoids risks.

- 3. The Emotional Spender: Uses money as comfort: travel, food, impulsive buys.

- 4. The Index Investor: Early adopter of SIPs, clarity driven, long term thinker.

- 5. The Crypto Curious: Explores high risk assets out of curiosity or FOMO.

Each archetype comes from a different emotional root, which we explore in the next chapter on psychology.

If you relate to emotional triggers, you may find this helpful:

The Balance Between Young Freedom and Adult Responsibility

Both Gen Z and young professionals are walking a rope between:

- wanting joy

- wanting security

- wanting freedom

- wanting stability

- wanting growth

- wanting rest

This balancing act creates tension, but it also creates maturity.

They are not choosing old rules blindly.

They are designing their own money values.

That, truly, is the beginning of a financial revolution.

What This Chapter Establishes

By now, you should feel three things:

- 1. You are not behind. You are navigating a complex world with remarkable strength.

- 2. Your relationship with money is shaped by your environment, not your “discipline.” And environments can be redesigned.

- 3. You are part of a generation that is building a new philosophy around money. One that blends: freedom + responsibility, experimentation + wisdom, ambition + calm.

Now, we move deeper.

CHAPTER II

The Psychology of Money Among India’s New Generation

There is a moment every young Indian experiences, somewhere between the salary credit message and the low balance notification, where money stops being math and becomes something far more intimate.

Money becomes emotion, identity, fear, hope, comparison, and sometimes, self worth.

To understand how Gen Z (18–25) and young professionals (26–35) manage money differently, we must first understand how they feel about money, because behavior always follows emotion.

This chapter is not about budgeting, SIPs, or inflation; that comes later.

This chapter is about your inner world, the one that quietly shapes every financial choice you make.

Why Emotions Drive Money More Than Logic

Let us begin with a simple truth:

Most people do not have a money problem; they have an emotion problem that shows up as a money problem.

This is not weakness.

It is neuroscience.

The part of your brain that processes emotions (the limbic system) reacts faster and stronger than the part that handles rational decisions.

This is why:

- You know a SIP is good for you…

- You know overspending harms you…

- You know credit card debt is dangerous…

…but you still struggle.

Because your brain is not fighting numbers.

It is fighting feelings.

If financial fatigue or anxiety has ever overwhelmed you, consider reading:

Related Reading:

The Psychological Origins: What Gen Z and Young Professionals Carry Within Them

Here is where Gen Z and young professionals begin to diverge.

They carry different emotional histories.

Gen Z Emotional Drivers

- 1. The “fast world” expectation: Everything moves fast: UPI, Instagram, YouTube, finance reels, crypto stories. This creates subconscious urgency: “If I am not growing fast, I am failing.”

- 2. Fear of missing out (FOMO): Not just social FOMO, but financial FOMO. Everyone else seems richer, quicker, earlier.

- 3. Identity through consumption: Clothes, tech, travel; spending becomes self expression.

- 4. Emotional uncertainty: The pandemic stole stability. They grew up watching chaos.

This leads to behavior like:

- trial and error investing

- impulse purchases

- extreme curiosity for new things

- inconsistent savings habits

- experimenting without long term planning

Gen Z is not reckless; they are reactionary to the world they inherited.

Young Professionals Emotional Drivers

- 1. The pressure of timelines: Marriage, home, career growth, parents’ expectations. Every rupee feels heavier.

- 2. Guilt around spending: The “responsible adult” script often clashes with wanting joy.

- 3. Career insecurity: Tech layoffs, startup volatility, AI disruption; the ground feels unstable.

- 4. Fear of falling behind: Seeing peers buy homes or achieve goals triggers self comparison.

This leads to behavior like:

- over saving or under saving

- hesitation to take investment risks

- pressure based spending (weddings, social obligations)

- overwork and burnout

- belief that “now or never” dictates financial decisions

Young professionals are not risk averse; they are responsibility driven.

The Hidden Emotional Biases That Influence Money Choices

Behavioral finance shows that humans do not make financial decisions rationally.

We are influenced by unconscious biases.

Let us look at the ones most present in young Indians.

Loss Aversion

We fear losing ₹1 more than we enjoy gaining ₹1.

This is why:

- Gen Z avoids long term investing because short term dips feel like failure.

- Young professionals avoid equity because they fear market crashes more than they desire wealth creation.

Loss feels personal.

Almost like a judgment of our intelligence.

If market volatility scares you, you may appreciate this perspective:

Mental Accounting

We treat money differently even though all money is equal.

Examples:

- Salary money feels “serious.”

- Side income feels “fun money.”

- Bonuses feel like “spending money.”

- Savings feel “untouchable.”

This explains inconsistent financial behavior across ages.

Hyperbolic Discounting

Choosing small pleasures now over big rewards later.

- Gen Z: “I will start investing next month.”

- Young professionals: “I will save after this EMI ends.”

The brain overvalues the present and undervalues the future.

Social Comparison Bias

We judge our financial progress by watching others, often strangers.

This is why Instagram has more impact on your spending than inflation.

It shapes desires, goals, and even insecurities.

If you struggle with comparison driven decisions, consider reading:

Decision Fatigue

We make hundreds of micro financial choices daily:

- UPI payments

- Swiggy orders

- subscriptions

- investments

- budgeting

Eventually, the brain gets tired and chooses the easiest option, usually the wrong one.

This is why financial planning feels exhausting.

It is not you. It is the cognitive load.

The 5 Money Archetypes of Young Indians (Psychology to Behavior)

Let us go deeper into the money personalities introduced earlier.

These archetypes are emotional mirrors, not labels.

You will likely see yourself in one or in a mix.

1. The Hustle Maxxer (Gen Z dominant)

Emotion: Urgency

Belief: “I must grow fast because the world is moving fast.”

Behavior:

- multiple gigs

- experimenting with high risk investments

- short term thinking

Linked reading:

2. The Silent Saver (Young professionals dominant)

Emotion: Fear

Belief: “If I lose money, I lose stability.”

Behavior:

- stick to FDs or RDs

- avoids equity

- saves but does not grow wealth

3. The Emotional Spender (common in both groups)

Emotion: Comfort, escape, identity

Belief: “Money can fix how I feel right now.”

Behavior:

- impulsive shopping

- over ordering food

- travel splurges

- emotional purchases

If this feels familiar:

4. The Strategic Planner (Young professionals dominant)

Emotion: Responsibility

Belief: “I must build a stable base before anything else.”

Behavior:

- SIPs

- insurance

- emergency funds

- long term goals

- reduced risk appetite

5. The Curious Investor (Gen Z dominant)

Emotion: Exploration

Belief: “Let me try. I will learn along the way.”

Behavior:

- small but frequent investments

- rapid learning

- inconsistent but improving patterns

- comfortable with apps and tools

These archetypes are fluid.

People shift between them depending on mood, season of life, or financial conditions.

The Emotional Triggers Behind Financial Decisions

Here are the psychological triggers that silently shape choices:

1. Fear

- Fear of losing money → avoidance of investing.

- Fear of stagnation → rushing into high risk options.

- Fear of judgement → social spending.

2. Identity

Buying things that feel like “who I am” or “who I want to be.”

This is more common in Gen Z.

3. Comfort

Spending to soothe:

- stress

- loneliness

- exhaustion

- comparison

- boredom

4. Control

Saving gives a sense of control when life feels unpredictable.

This is why young professionals often over save.

5. Validation

Spending to feel “caught up” with peers.

This is stronger in both age groups than most admit.

Why Most Young Indians Struggle to Build Consistent Habits

It is not a discipline problem.

It is a design problem.

Young Indians struggle because:

- Money is not predictable.

- Careers are unstable.

- Choices are overwhelming.

- Emotions fluctuate.

- Information overload is real.

- Apps and notifications constantly push spending.

Consistency is difficult when the environment is chaotic.

This is exactly why building a simple system works better than relying on “willpower.”

If this resonates, you may explore:

Related Reading:

- Your Financial System Needs a Dashboard — Not Just Dreams

- Build a Strong SIP Habit: Your Simple 12-Month Plan for Beginners

The Psychological Divide Between Gen Z and Young Professionals

Let us break it down clearly.

Gen Z (18–25) Core Drivers

- Experimentation > Stability

- Identity > Responsibility

- Curiosity > Structure

- Fast rewards > Long term returns

- Flexibility > Routine

Core driver: Freedom

Young Professionals (26–35) Core Drivers

- Stability > Experimentation

- Responsibility > Identity

- Structure > Curiosity

- Long term > Short term

- Routine > Flexibility

Core driver: Security

Neither is “better.”

Each is shaped by life stage, emotional needs, and environment.

Why Understanding Money Psychology Matters (Before Math or Strategy)

Because behavior changes only when emotion becomes conscious.

Once you understand why you:

- spend

- save

- avoid

- delay

- fear

- rush

…you gain back control.

Clarity creates calm.

Calm creates consistency.

Consistency creates wealth.

This is the foundation for the next chapters.

CHAPTER III

The Financial Mathematics of Behavior

Money feels emotional. But money moves mathematically. This chapter grounds everything in logic: income flows, compound growth, how small behaviours accumulate, why inconsistency is expensive, how Gen Z and young professionals differ in actual financial math, and how to read your money decisions like data, not judgments. Imagine this chapter as a shift from “inner world” to “outer structure.” Let us begin by simplifying the complex.

The Core Formula: Income, Spending, Saving, Investing

Every rupee you earn eventually goes into one of four buckets: Income → Spending → Saving → Investing This formula seems simple, but it is a complete financial system. Your entire life fits into those four words. What differentiates Gen Z from young professionals is not knowledge; it is allocation behaviour.

Gen Z Financial Allocation: Leakage and High Risk

Typical patterns (from surveys and behavioural studies): Income sources: • internship stipends (₹8,000 to ₹25,000) • freelance work (₹5,000 to ₹50,000) • early career salaries (₹18,000 to ₹35,000) • creator income • gig economy earnings Allocation pattern: • 45 to 65% spending (tech, experiences, food, lifestyle) • 10 to 20% impulsive spending (FOMO driven) • 10 to 20% saving (depending on stability) • 5 to 15% investing (high risk, inconsistent) Why this happens: • unstable income leads to unstable habits • higher curiosity leads to higher experimentation • lower future pressure leads to lower savings consistency • higher digital exposure leads to higher micro spending Mathematically, Gen Z faces leakage: small expenses that quietly drain ₹2,000 to ₹10,000 every month. If you have struggled with this type of leakage, this guide may help you understand the emotional roots: Related Reading: • Emotional Spending Psychology: Why We Buy What We Don’t Need (And How to Stop)

Young Professionals’ Allocation: Rigidity and Fixed Costs

Income sources: • primary salary (₹25,000 to ₹90,000) • occasional side income • bonuses • performance incentives Allocation pattern: • 30 to 45% obligations (rent, bills, EMIs) • 20 to 35% spending (social, family, lifestyle) • 10 to 25% saving (moderate consistency) • 10 to 20% investing (mostly SIPs or mutual funds) • 5 to 10% emotional spending (weddings, family expectations, gifts) Young professionals face a different mathematical problem: rigidity. Expenses are fixed. Income rises slowly. Investing starts late. Responsibilities grow fast. This creates pressure. If this pressure ever makes you chase shortcuts, you might reflect on: • Why You Keep Chasing Quick Profits

The High Cost of Inconsistency (Financial Math)

Most young people do not fail financially due to bad decisions. They fail due to inconsistency. Let us understand the math. Example: If you save ₹3,000/month, the math looks like: • 1 month: ₹3,000 • 1 year: ₹36,000 • 10 years (no investing): ₹3,60,000 But if you do this inconsistently (save 5 months, skip 7 months), you get:

- 5 months × ₹3,000 = ₹15,000 saved

- 7 months × ₹0 = ₹0 saved

- Year total: ₹15,000 (instead of 36,000)

- 10-year total: ₹1,50,000 (instead of 3,60,000)

Inconsistency reduces long term wealth by almost 60%. This is why small, steady actions outperform big, intense actions. If building consistency feels overwhelming, this might help: • Build a Strong SIP Habit: Your Simple 12-Month Plan

The Power of Compounding: Small Becomes Big

Now let’s apply investing math, assuming 10–12% returns (typical for Indian index funds).

Scenario A: ₹3,000/month SIP for 10 years @ 12%

Future value ≈ ₹6.97 lakh

Scenario B: ₹3,000/month SIP for 10 years, but with gaps (only 5 months per year)

Future value ≈ ₹2.9 lakh

That’s a ₹4 lakh difference, just because of inconsistency.

The emotional takeaway?

You don’t need more money.

You need more regularity.

This is why steady SIP habits outperform risky shortcuts, as discussed in: • The Path to Real Wealth: Why Patience and Compounding Beat Shortcuts

The Cost of Delaying Investment: Time is Greater Than Money

Let us compare two people: Person A: Gen Z Investor (starts at 22)

SIPs: ₹2,000/month

Duration: 13 years

Stops at 35

Let it grow until 50

Returns @ 12%

Final value ≈ ₹34–36 lakh

Person B: Young Professional (starts at 30)

SIPs: ₹5,000/month

Duration: 20 years

Returns @ 12%

Final value ≈

₹48–50 lakh

Despite investing 2.5x more monthly, the older investor barely beats the younger one.

Why? Time > Money.

This is the single biggest numeric advantage Gen Z holds.

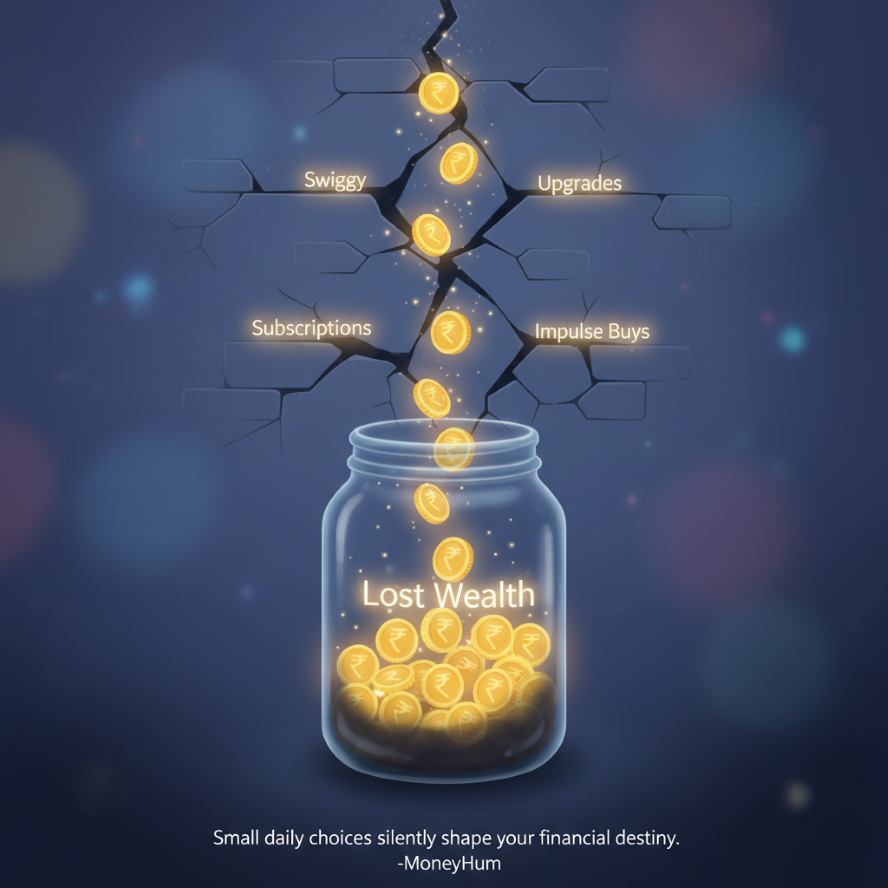

Financial Leakage: The Annual Cost of Micro-Spending

Let us zoom into “micro decisions,” where most young Indians lose silent money. Swiggy/Zomato • Average: ₹120 to 300/order • Frequency: 8 to 20 times monthly • Annual impact: ₹14,000 to ₹72,000 Coffee/Tea • Average: ₹80 to 200 • If purchased daily: • Annual cost: ₹29,000 to ₹73,000 Online Shopping Micro-Items • Average: ₹300 to 1,500 per purchase • Monthly average: present mostly as impulsive spending • Annual cost: ₹12,000 to ₹60,000 Upgrading gadgets frequently • Unnecessary upgrades every 1 to 2 years • Annualized cost: ₹20,000 to ₹60,000 Total annual leakage (moderate lifestyle): ₹60,000 to ₹2,50,000 per year If invested (₹5,000/month SIP):

20-year value @12% ≈ ₹50–55 lakh

This is the math behind financial freedom.

Small leaks → big losses.

Small habits → big returns.

The Income vs. Expense Growth Gap

• Typical Indian salary growth (avg.): 7 to 12% annually • Typical expense growth: 10 to 18% annually (due to lifestyle inflation plus actual inflation) This creates a gap. Even if your income grows, your lifestyle often grows faster. This explains why: • young professionals feel stuck • Gen Z feels pressure to increase income fast • many feel they are “falling behind” despite earning more This also explains the rise of India’s side income culture. If you are exploring this path: • Side Income Ideas for 2025: Earn ₹5,000 to ₹20,000 Monthly

The Real Cost of High Interest Debt (Credit Cards & EMIs)

• Credit card interest = 24 to 48% annually • Personal loans = 12 to 24% This means: • buying a phone on EMI • taking a vacation on credit • impulse purchases …may actually cost 20 to 70% more over time. This reinforces psychological guilt cycles, especially for young professionals. Thankfully, debt can be managed smartly through structured methods: • Debt Repayment Fast Track: Snowball vs Avalanche Methods

The Fixed vs. Flexible Expense Structure

Let us compare the two age groups mathematically: Gen Z (Flexible expense-heavy) • variable spending: 60 to 70% • fixed obligations: 10 to 25% • investing: inconsistent • savings: inconsistent • Strength: agility • Weakness: leakages Young Professionals (Fixed expense-heavy) • fixed obligations: 40 to 60% • discretionary spending: 20 to 30% • investing: moderate • savings: moderate • Strength: structure • Weakness: rigidity Both need balance. Both have blind spots.

Decoding Behavior: What the Math Reveals

Let us decode the deeper meaning. Gen Z is not irresponsible. Their math shows they are flexible, which is useful early in life, but needs alignment with long term goals. Young professionals are not boring. Their math shows they are structured, which creates stability, but sometimes at the cost of growth.

Bridging the Divide: Lessons for Both Generations

Here is the rational takeaway: What Gen Z can learn from young professionals: • consistency beats experimentation • spending requires boundaries • risk is good, but not directionless • long term investing yields power • EMI lifestyle equals long term stress What young professionals can learn from Gen Z: • flexibility leads to adaptability • experimentation teaches faster • side income culture reduces pressure • tech first money habits increase clarity • risk is not the enemy; unmanaged risk is

From Math to Action: Preparing for Structural Change

Now that the numbers are clear, you are prepared for Chapter 4, where we go deeper into the split paths: • different life pressures • different behaviors • different stresses • different strengths • specific actionable steps for each age group But before that, take one truth from this chapter:

Money is emotional, yes, but money behaves mathematically.

If you master the math, the emotions calm down. This is how rational clarity brings emotional peace.

CHAPTER IV

The Split Path: How Gen Z & Young Professionals Manage Money Differently

There is a moment in every young Indian’s life when money stops being an abstract concept and becomes a mirror. You begin to notice how you spend, how you save, what you fear, and what you chase, and suddenly, you realize something:

Not everyone walks the same financial path. Even people of the same age behave differently with money.

In this chapter, we look at the two dominant paths in India today:

- GEN Z (18–25): fast, flexible, experimental

- YOUNG PROFESSIONALS (26–35): structured, pressured, responsible

Both are shaped by the world they grew up in, the expectations placed on them, and the emotional stories they carry about money.

The Core Motivation: Freedom vs Stability

Let us begin with the deepest truth.

Gen Z’s core financial driver → FREEDOM

They want the ability to make choices without depending on anyone.

Young Professional’s core financial driver → STABILITY

They want predictability, structure, and long term security.

This difference alone shapes almost every behavior.

The Emotional Landscape Behind Decisions

Money decisions start in emotion.

Here is how both groups differ internally:

Gen Z Emotional Triggers

- “Am I catching up fast enough?”

- “What if I miss an opportunity?”

- “I want to enjoy life now.”

- “I will figure it out later.”

- “Everyone seems ahead of me.”

Dominant emotional triggers:

- FOMO

- comparison

- identity

- curiosity

- desire for independence

Young Professionals Emotional Triggers

- “I need to be responsible.”

- “What if something goes wrong?”

- “Will I be able to afford the future?”

- “I cannot make a mistake.”

- “I must settle down.”

Dominant emotional triggers:

- fear

- pressure

- guilt

- duty

- long term anxiety

If money triggered anxiety is something you relate to, you may appreciate:

Related Reading:

Income Patterns: The Foundation Splits Here

Gen Z Income Structure

Income is fluid.

Stipends, freelance gigs, internship money, small salaries.

Unpredictable, but adaptable.

Young Professionals Income Structure

Income is fixed but under pressure.

Stable salary, some bonus, maybe a side income.

Predictable, but burdened by responsibilities.

This income structure shapes the entire financial path.

Spending Behavior: Identity vs Obligation

Gen Z (identity driven spending)

They spend to express who they are.

This includes:

- fashion

- gadgets

- food delivery

- experiences

- travel

- small lifestyle luxuries

- upgrading tech frequently

Money becomes a tool to create identity and independence.

Young Professionals (responsibility driven spending)

They spend on obligations:

- rent

- EMIs

- utilities

- weddings

- supporting parents

- groceries

- transportation

Money becomes a tool to survive, sustain, and support.

They also spend on escape: travel, dinners, movies, to cope with stress.

Understanding emotional spending is useful for both groups:

Saving Behavior: Stability vs Flexibility

Gen Z Savings Habits

Saves inconsistently.

Not because they do not care, but because:

- income fluctuates

- expenses are unpredictable

- there is less urgency

Savings usually come last.

Young Professionals Savings Habits

Save more consistently, often out of fear.

Their savings create a feeling of control in a chaotic world.

But many save without a plan, meaning the savings do not grow meaningfully.

This is where structured systems help:

Related Reading:

Investing Behavior: Risk vs Caution

This is where the contrast becomes sharp.

Gen Z — Risk Friendly

- crypto

- trading

- small but frequent investments

- curiosity driven choices

- experiments with new platforms

Strength: They start early.

Weakness: They may chase fast returns.

If quick gains attract you, this piece offers deeper insight:

Young Professionals — Cautious & Structured

- SIPs

- index funds

- insurance

- retirement planning

- mutual funds

Strength: They invest in stable, proven methods.

Weakness: They sometimes wait too long or invest too conservatively.

A balanced investing approach can be found in:

Debt Behavior: Two Very Different Stories

Gen Z Debt Profile

Low debt, but dangerous impulses:

- BNPL (Buy Now Pay Later)

- credit cards with small limits

- EMIs for phones/gadgets

Debt is emotional, tied to desire and identity.

Young Professionals Debt Profile

Higher debt, but structured:

- car EMI

- home loans

- personal loans

- marriage expenses

- credit card cycles

Debt is stressful, tied to responsibility and pressure.

Effective management strategies here:

Lifestyle Inflation: When Life Moves Faster Than Income

Lifestyle inflation hits both groups, but differently.

Gen Z Lifestyle Inflation

Driven by social media comparison.

Every new trend feels urgent.

Young Professionals Lifestyle Inflation

Driven by expectations.

Weddings, gifts, promotions, festivals; all bring social pressure.

The danger?

Income grows slowly.

Lifestyle grows constantly.

This is why long term stability requires a framework:

Case Studies: Two Lives, Two Very Different Money Journeys

Let us bring this to life with two relatable stories.

CASE STUDY 1: Aditi (22, Gen Z)

- stipend ₹18,000

- freelances occasionally

- spends ₹10,000 on lifestyle

- invests ₹1,000 in random stocks

- saves ₹2,000–3,000 when possible

- wants to “enjoy life now”

- feels guilty sometimes

- often says: “I will start investing properly later.”

Pattern: flexible, inconsistent

Outcome: high potential, low execution

CASE STUDY 2: Rohan (29, Young Professional)

- salary ₹55,000

- spends ₹30,000 on obligations

- EMI: ₹12,000

- invests consistently ₹5,000

- saves ₹3,000

- feels constant pressure

- often says: “Am I too late?”

Pattern: structured, stressed

Outcome: consistent but limited growth

What these stories show:

Gen Z has time, but lacks direction.

Young professionals have direction, but lack time.

What Each Group Can Learn From the Other

This is where the magic lies.

Each group holds the missing piece for the other.

What Gen Z can learn from young professionals:

- consistency beats intensity

- start SIPs early

- learn long term thinking

- avoid EMIs

- build emergency funds

- invest even small amounts

- diversify beyond “trendy” assets

What young professionals can learn from Gen Z:

- experiment with new income streams

- increase risk tolerance (strategically)

- be flexible with opportunities

- upskill continuously

- adopt digital first tools

- avoid fear driven investing

- embrace change instead of resisting

The Real Divide Is Not Age; It Is Mindset

Let us break a myth:

The difference between Gen Z and young professionals is not who makes more money; it is who uses money more consciously.

A 22 year old can be more financially mature than a 32 year old, and vice versa.

The true divide is emotional:

- Do you spend from fear or identity?

- Do you save for stability or guilt?

- Do you invest from confidence or pressure?

- Do you work for money or do you design money to work for you?

This mindset shift is what we will build in Chapter 5.

India’s Two Paths Are Now Merging

Despite differences, both paths are slowly converging.

We see a new trend:

Young Indians want both freedom and stability. They want to enjoy life and grow wealth. They want to live fully and live wisely.

This is possible only when you combine:

- Gen Z flexibility

- Young professional discipline

- Mathematical clarity

- Psychological awareness

This creates the foundation for something powerful:

A personal money system that works for your life instead of controlling your life.

Exactly what we will build in the next chapter.

CHAPTER V

Bridging Emotion with Action: A Practical, Step-by-Step Life System

If the first four chapters helped you understand the inner world of money (the emotions, the psychology, the differences between Gen Z and young professionals), then this chapter builds the outer world: a real, usable system that makes financial life calm, predictable, and sustainable.

Think of this chapter as the moment where thought becomes strategy, and strategy becomes action.

Because understanding yourself is only half the journey.

The other half is building a money system that works even when life gets chaotic, motivation drops, or emotions waver.

Let us build that system: gently, rationally, and step by step.

The Four-Pillar Money Life System (Simple, Rational, Foolproof)

No matter your age, income, city, or circumstances, your financial life can be built on four pillars:

- Pillar 1 — Stability: Your emergency fund, safety net, buffers.

- Pillar 2 — Clarity: Your dashboard, tracking, awareness, visibility.

- Pillar 3 — Growth: Your SIPs, index funds, long term compounding.

- Pillar 4 — Freedom: Your side income, creative work, skill driven earnings.

This is the most minimal, reliable, failure proof structure for modern India.

Let us break each one down with separate steps for Gen Z and young professionals.

PILLAR 1 — STABILITY (Emergency Fund and Zero Debt Framework)

Most financial stress does not come from a lack of money.

It comes from a lack of stability.

An emergency fund is not just money; it is emotional safety.

Goal:

Build 3–6 months of expenses as a buffer.

(Gen Z: 2–3 months is enough initially. Young professionals: 3–6 months minimum.)

Where to keep it?

- 50–70% in a high interest savings account

- 30–50% in a liquid mutual fund

For a full explanation of how much and where, you can explore:

Related Reading:

If You Are Gen Z (18–25): Start with a Mini Fund

Young income = unstable income.

So, start small.

- Goal 1: ₹5,000

- Goal 2: ₹10,000

- Goal 3: One month of expenses

Automate ₹500–₹1,000 per month into a liquid fund.

If You Are a Young Professional (26–35): Build a Strong Buffer

You have obligations.

Your emergency fund must be treated as priority, not optional.

- Goal 1: One month of expenses

- Goal 2: Three months

- Goal 3: Six months

Why does this matter?

Because without a stability pillar, investing becomes emotional.

Every market dip creates fear.

Every expense creates panic.

Every risk feels heavy.

Stability gives mental breathing space.

PILLAR 2 — CLARITY (Your Dashboard System: Because the Brain Cannot Manage What It Cannot See)

Most people do not have a money problem; they have a visibility problem.

When you cannot see where money is going, your brain fills the gaps with:

- stress

- assumptions

- guilt

- overthinking

Clarity fixes this instantly.

Goal:

Build a simple monthly dashboard that shows:

- Income

- Fixed expenses

- Variable expenses

- Savings

- Investments

- Debt

- Net worth

You do not need complicated apps.

A simple Google Sheet works.

For a complete guide to designing this system, read:

Related Reading:

If You Are Gen Z: Build a Lightweight Dashboard

Track only 3 things:

- money coming in

- money going out

- money growing

Do not aim for perfection; aim for awareness.

If You Are a Young Professional: Build a Structure

Track:

- rent/EMIs

- groceries

- transport

- utilities

- lifestyle

- investments

- side income

- net worth growth

Clarity reduces 70% of financial anxiety because the unknown becomes known.

PILLAR 3 — GROWTH (SIPs, Index Funds, Risk Allocation, Long Term Strategy)

This is the pillar that builds wealth quietly, over years, not days.

Most young Indians believe investing is complicated.

It is not.

It is simply automating small monthly amounts into long term assets.

Goal:

Start a SIP.

Any amount.

Any index fund.

But start.

Even ₹500 matters.

For beginners, this guide simplifies everything:

Related Reading:

- How to Choose the Right Mutual Fund: A Behavioral Checklist for Indian Investors

- Build a Strong SIP Habit: Your Simple 12-Month Plan for Beginners

If You Are Gen Z: Start Small, Be Consistent

Target:

- ₹500 to ₹2,000 per month

- Nifty 50 index fund

- Automate your SIP

- Do NOT stop during market dips

- Increase by ₹250 every 6 months

Your biggest advantage is time, not income.

A 22 year old investing ₹1,000/month beats a 30 year old investing ₹3,000/month.

If You Are a Young Professional: Build a Three Part Growth Structure

Part 1 — Wealth Base (60–70%)

- Nifty 50

- Nifty Next 50

- Large cap mutual funds

- Debt funds (optional)

Part 2 — Medium Risk (20–30%)

- Flexi cap funds

- Sector funds (limited)

Part 3 — High Risk (10–20%)

- Direct stocks

- Small cap funds

- International ETFs

Do not chase trends.

Chase consistency.

If you are tempted by shortcuts, consider:

PILLAR 4 — FREEDOM (Side Income + Skills + Optionality)

This is the pillar most people ignore, yet it creates the biggest psychological relief.

Side income removes pressure from your main job and increases your confidence.

Goal:

Earn an extra ₹3,000–₹20,000/month from skills, not stress.

This does not have to be a business.

It can be:

- freelancing

- digital work

- part time consulting

- teaching

- editing

- graphic design

- content writing

- internships

- weekend gigs

For practical ideas:

Related Reading:

If You Are Gen Z: Build Skill Based Micro Incomes

You have energy and flexibility.

Use it to:

- learn high leverage skills

- freelance

- earn small but steady income streams

This builds confidence fast.

If You Are a Young Professional: Create Optionality

You are busy.

But you can still:

- consult on weekends

- offer online services

- monetize your expertise

- create a digital product

- build a career backup

Freedom does not require quitting your job.

It requires expanding your options.

The 30-Minute Monthly Money Ritual (Your Anchor Habit)

If you want to simplify your financial life dramatically, do this once every month:

Step 1 — Check your dashboard

Income → expenses → savings → net worth.

Step 2 — Adjust SIPs

Increase SIP by ₹250–₹1,000 if possible.

Step 3 — Review lifestyle inflation

Ask: “Did my spending grow faster than my income?”

Step 4 — Three questions

- Did I spend emotionally?

- Did I invest consistently?

- Did I move closer to stability?

Step 5 — Reset goals

1–2 clear intentions for the next month.

That is it.

30 minutes → clarity, calm, and control.

Custom Action Plan for Gen Z vs Young Professionals

Let us distill everything into simple paths.

If You Are Gen Z (18–25)

Focus on:

- mini emergency fund

- small SIPs

- side income skills

- avoiding EMIs

- avoiding trend based investing

- clarity through lightweight tracking

Your monthly plan:

- SIP: ₹500–2,000

- Savings: ₹1,000–3,000

- Skill building: 5 hours/week

- Dashboard: updated monthly

If You Are a Young Professional (26–35)

Focus on:

- 3–6 months emergency fund

- consistent SIPs

- structured investing

- managing lifestyle inflation

- exploring low pressure side income

- reducing emotional spending

Your monthly plan:

- SIP: 15–25% of income

- Savings: 10–20%

- Dashboard: update every 15–30 days

- Upskill: 2 hours/week

- Debt reduction: as needed

What This System Gives You (Emotionally and Practically)

Emotionally:

- less anxiety

- more control

- fewer impulsive decisions

- calmer long term thinking

Practically:

- predictable savings

- consistent investing

- growing net worth

- freedom based income

- reduced debt risk

Money becomes a system, not a stress source.

CHAPTER VI

The Culture Behind Money: Family, Pressure, Society & Identity

Money in India is not just money.

It is culture.

It is expectation.

It is tradition.

It is reputation.

It is duty.

It is pressure.

It is belonging.

It is identity.

Unlike many Western countries where money decisions are highly individual, young Indians grow up in an emotional ecosystem where every financial choice is deeply entangled with family, society, and cultural narratives.

In this chapter, we explore the invisible cultural forces that shape how Gen Z and young professionals think, feel, and behave with money, often without realizing it.

Because understanding these forces helps you breathe.

It helps you forgive yourself.

It helps you make money decisions that are not driven by pressure, but by clarity.

The Invisible Weight: “Log Kya Kahenge” Economics

There is no phrase that influences Indian spending more than:

“Log kya kahenge?”

(What will people say?)

This cultural pressure shapes:

- weddings

- gifting

- lifestyles

- home buying

- car ownership

- even where you travel

You can be financially responsible all year and still spend ₹1–3 lakh on “social expectations” in a single wedding season.

For Gen Z

It shows up as:

- buying clothes to match trends

- upgrading phones to “fit in”

- spending on travel for Instagram validation

For Young Professionals

It shows up as:

- marriage expenses

- gifts for relatives

- buying a car “because everyone else has one”

- moving into a bigger house even if it strains finances

This is why many Indians feel financially stuck, not because income is low, but because social pressure is high.

If this pressure creates anxiety, you may find clarity in:

Related Reading:

The Family Expectation Loop

Indian families are deeply interdependent.

This is beautiful and challenging.

Here is the hidden loop:

- Parents invest heavily in children

- Children grow up feeling indebted (emotionally, not financially)

- Once employed, children feel responsible to “give back”

- This creates pressure on savings and investment

- Which delays financial independence

- Which keeps the cycle going

This loop is especially strong for young professionals.

For Gen Z

Expectations are lower but increasing.

Parents still fund most large expenses.

But subtle pressure exists:

- “perform well”

- “make something of your life”

- “do not waste opportunities”

- “do not fall behind relatives’ kids”

This pressure often creates the Gen Z desire for fast success and instant achievement.

For Young Professionals

Expectations are explicit:

- contribute at home

- help with bills

- support siblings

- save for marriage

- plan for future family

- send money back home

- invest “responsibly”

Young professionals carry emotional and financial responsibilities simultaneously, which creates tension between personal goals and family duty.

This is one reason financial anxiety is higher in the 26–35 age group.

If you resonate, this might help:

The Marriage Timeline Pressure

In India, marriage is not just a personal event; it is an economic event.

Costs include:

- gifts

- travel

- ceremonies

- clothes

- family expectations

- social obligations

Even if you want a simple wedding, families may insist otherwise.

For Gen Z:

Marriage feels distant, but the pressure starts subconsciously early:

- parents mention it

- relatives comment

- society reminds you

For Young Professionals:

Marriage becomes a financial axis:

- should we save for it?

- should we invest for it?

- how much is “appropriate”?

- who pays for what?

This pressure often leads to:

- loans

- depleted savings

- postponement of financial goals

- guilt around self spending

Marriage alone can delay wealth creation by 2–5 years for many Indians.

Lifestyle Expectations and Social Comparison

Comparison culture is stronger in India than most places.

Why?

Because life is communal.

People know everything:

- your salary

- your car

- your house rent

- your wedding plans

- your job title

- your success

This creates invisible financial pressure.

Gen Z compares on Instagram.

Young professionals compare on LinkedIn and in social circles.

Gen Z comparison triggers:

- travel

- fitness

- clothes

- gadgets

- social life

- influencer lifestyles

Young professional comparison triggers:

- promotions

- home buying

- cars

- marriage spending

- EMIs

- “settling down”

This comparison often leads to emotional spending, a topic we explore deeply here:

The Indian Money Trauma Cycle

Every Indian household carries unspoken financial wounds.

Common money traumas:

- losing a job

- family debt

- sudden medical expenses

- business losses

- financial instability during childhood

- scarcity mindset passed down from previous generations

These traumas create deeply ingrained beliefs.

Gen Z inherits trauma indirectly

They saw:

- parents stressed over money

- earnings disappear suddenly

- sacrifices made silently

- relatives asking for help

- family arguments over finances

This creates:

- fear of missing out

- desire for fast money

- avoidance of long term plans

- emotional triggers around financial control

Young Professionals inherit trauma directly

They often carry:

- guilt from family sacrifices

- pressure to support aging parents

- fear of losing stability

- risk avoidance

- belief that “everything can collapse at any moment”

This leads to:

- conservative investing

- over saving

- career anxiety

- fear based financial choices

Understanding trauma allows you to break cycles consciously.

Career Pressure in the Indian Context

Young Indians face a unique career environment:

- intense competition

- rapid automation

- slow promotions

- high cost of living

- unstable startups

- uncertain job markets

- unrealistic expectations from society

This creates financial behaviors shaped by fear, urgency, and insecurity.

Gen Z reacts by:

- exploring multiple skills

- chasing fast opportunities

- preferring flexible work

- disliking traditional jobs

Young professionals react by:

- overworking

- staying in jobs they dislike

- delaying risk taking

- internalizing career guilt

This is why many young professionals feel stuck in hustle culture, something we explore more in:

Indian Family Structure and Money Identity

One of the biggest cultural factors is this:

Indian children do not truly separate from their parents, even emotionally, until their 30s.

This influences money identity in three ways:

- 1. Your financial decisions affect your family: Buying a home, changing jobs, moving cities; everything affects others.

- 2. Your family’s opinions influence your risk appetite: Parents often recommend FDs, gold, LIC, and traditional methods. This creates internal conflict between modern financial wisdom and parental expectations.

- 3. You carry unconscious financial beliefs from childhood: Examples: “Money is hard to earn.” “Debt is shameful.” “Savings equal safety.” “Risk is dangerous.” “Family comes first.” These beliefs shape your behavior more than market trends.

The Social Pressure to “Look Successful”

Young Indians live in a time where success is visible.

You can see your peers’ lives.

You can see their achievements.

You can see their lifestyle.

This creates pressure to project success before building it.

This leads to:

- new phones

- branded clothing

- frequent travel

- EMIs

- expensive weddings

- social spending

- lifestyle inflation

Success becomes a performance, not a journey.

If this pressure makes you feel “behind,” this guide may help realign your perspective:

The Clash Between Tradition and Modernity

This is the heart of India’s financial evolution.

Traditional India says:

- Save more

- Buy a home

- Avoid debt

- Minimize risk

- Work one stable job

Modern India says:

- Invest early

- Rent makes sense

- Credit is manageable

- Risk is necessary

- Multiple income streams matter

Gen Z leans modern.

Young professionals straddle both worlds.

This clash creates confusion and guilt.

Understanding this helps you make decisions from clarity, not conflict.

The Path Forward: Designing Your Own Money Culture

You do not have to follow Western methods.

You do not have to follow Indian traditions blindly.

You do not have to copy your peers.

You do not have to match your parents’ expectations.

You can design a personal money philosophy built on:

- rationality

- clarity

- calm growth

- self awareness

- emotional intelligence

- long term thinking

You can take the best of both worlds:

Indian values + modern systems.

This is the bridge to the next chapter.

**CHAPTER VII

A New Money Philosophy for a New India**

There comes a point in every financial journey when strategies, tips, and numbers stop being enough.

Because money is not just something you manage.

It is something you live with.

Every day.

In your decisions, your habits, your self worth, your relationships, your future.

If you zoom out far enough, you begin to see something important:

India’s new generation is not just adjusting to a new financial world; they are creating one. A new money philosophy. A new identity. A new way of being.

This chapter is that philosophy.

A rational, emotionally intelligent, culturally rooted way of living with money, designed for the India that exists today, not the India of the past.

Let us build it together.

The Shift From Performance to Peace

For decades, money in India was a performance metric:

- How much do you earn?

- What have you bought?

- What does your lifestyle show?

- What does your car say about you?

- What does your wedding say about your family?

But today, something is changing.

Gen Z does not want to “look rich.”

Young professionals do not want to “pretend successful.”

Both want something deeper:

A financial life that feels peaceful, not performative.

This means money is no longer a scoreboard.

It is a tool for stability, for choice, for freedom, and for inner calm.

The question is shifting from:

“How much do I have?”

to

“What can I do because I have enough?”

Redefining “Enough” — A Silent Revolution

Your parents’ generation defined enough as:

- one home

- one car

- one stable job

- one retirement fund

For young Indians today, “enough” has changed meaning.

For Gen Z

“Enough” means freedom to explore.

Freedom to leave a job.

Freedom to choose your path.

For Young Professionals

“Enough” means stability without fear.

A buffer big enough to breathe.

A system strong enough to grow.

The new definition of enough is psychological, not mathematical.

It is the point where:

- you stop checking your bank balance with fear

- you stop comparing your life to others

- you stop spending to impress

- you stop saving out of guilt

- you stop chasing quick gains

- you start building with calm

- you start choosing intentionally

- you start trusting the process

If you want to deepen this reflection, you may explore:

Related Reading:

Quiet Wealth vs Flashy Wealth

A new trend is emerging among young Indians:

Flashy wealth exhausts. Quiet wealth empowers.

Let us compare the two:

Flashy Wealth (Old Script)

- visible

- quick

- high pressure

- comparison driven

- EMI driven

- identity based

- emotionally unstable

Quiet Wealth (New Script)

- invisible

- slow

- low pressure

- self driven

- savings + SIP based

- identity neutral

- emotionally stable

Quiet wealth does not show.

It grows.

A person investing ₹5,000 monthly consistently is wealthier than someone spending ₹50,000 to appear wealthy.

Quiet wealth is patient.

Quiet wealth is strategic.

Quiet wealth is powerful.

You will find deeper insights here:

A New Financial Identity for a Modern India

Here is the truth most young Indians feel but rarely say:

“I want to live a life that feels like mine.”

A life where:

- money supports choices, not controls them

- money empowers dreams, not replaces them

- money creates calm, not chaos

This requires a new type of financial identity:

Identity of Clarity

You know your numbers.

You know your habits.

You know your direction.

Identity of Balance

Work + rest

Saving + enjoying

Safety + growth

Discipline + softness

Identity of Agency

You choose how you earn.

You choose how you spend.

You choose how you grow.

Identity of Maturity

You seek long term success over short term dopamine.

You build systems, not impulses.

You grow without noise.

If you feel lost or overwhelmed, remember:

Quiet growth is still growth.

Calm progress is still progress.

The 3 Core Principles of the New Indian Money Philosophy

Let us crystallize this new worldview into three clear principles.

PRINCIPLE 1 — Simplicity Outperforms Complexity

Most people do not need:

- 15 apps

- 20 mutual funds

- 10 debt instruments

- 5 side incomes

They need a simple system that works every month.

This is why money dashboards matter so much:

Related Reading:

Simplicity removes overwhelm.

Overwhelm kills consistency.

Consistency builds wealth.

PRINCIPLE 2 — Start Small, Stay Steady

Every financial journey is built on two truths:

- Starting early > starting big

- Being consistent > being perfect

A 22 year old investing ₹500/month is more powerful than a 30 year old investing ₹3,000/month.

David beats Goliath.

Time beats income.

Habits beat motivation.

If you want a structured routine, explore:

PRINCIPLE 3 — Build the Life You Want, Not the Life Others Expect

This is the foundation of emotional freedom.

You do not have to:

- buy a car because “it is time”

- buy a house because “rent is waste”

- have a big wedding because “people will talk”

- follow a career path because “family says so”

Your money must serve your life, not society’s timeline.

This requires courage.

But it also requires clarity.

And both are available to you.

The 5 Practices of a Calm, Rational Financial Life

Let us ground this philosophy into daily behaviors.

PRACTICE 1 — Monthly Awareness Ritual

Every 30 days:

- check spending

- check SIPs

- check savings

- check goals

It takes 20 minutes.

It changes everything.

PRACTICE 2 — Emotional Budgeting

Ask one question before spending:

“Am I buying this for comfort, identity, or need?”

This single question prevents most wasted rupees.

For deeper understanding:

PRACTICE 3 — Automatic Investing

Automate SIPs.

Do not rely on willpower.

Willpower is emotional.

Automation is rational.

PRACTICE 4 — Strategic Risk Taking

Not reckless risk.

Not emotional risk.

But planned, intelligent risk.

Especially important for young professionals who tend to avoid risk.

If you want an overview of options:

PRACTICE 5 — Create Optionality

Optionality = choices.

Side income = choices.

Skills = choices.

Emergency fund = choices.

Savings = choices.

The more choices you have, the less fear you feel.

Explore ideas here:

A Bridge Between Two Generations

What makes India’s current moment unique is that two generations are learning money together.

Gen Z brings:

- adaptability

- experimentation

- risk appetite

- digital native thinking

Young professionals bring:

- discipline

- structure

- responsibility

- long term focus

Together, they form a powerful blend.

A blend that can create wealth:

- calmly

- steadily

- intelligently

- sustainably

This synergy is the future of India’s financial landscape.

The Final Shift: From Scarcity to Abundance, From Fear to Agency

For decades, Indian families lived with a scarcity mindset:

- save everything

- risk nothing

- avoid mistakes

- fear loss

India’s new generation is shifting to an abundance mindset:

- invest early

- grow steadily

- take smart risks

- trust time

- build quietly

- plan intentionally

This mindset is not about extravagance.

It is about security, confidence, and freedom.

What This New Philosophy Gives You

Emotionally:

- less anxiety

- fewer compulsions

- more clarity

- more balance

- more confidence

- more control

- peace with your journey

Practically:

- consistent investing

- strong savings

- predictable growth

- reduced risk

- long term wealth

- financial resilience

This philosophy is not about getting rich fast.

It is about getting secure, calm, and steady, for life.

FINAL CONCLUSION: The Road Ahead

You have reached the end of a very deep journey, not just through money, but through the emotional, cultural, psychological layers that silently shape your financial life.

If you have read everything till here, it means one thing:

You are ready for a different relationship with money. A calmer one. A clearer one. A more intentional one.

The truth is…

Money becomes easier the moment you stop fighting yourself and start understanding yourself.

India’s Gen Z and young professionals are not “bad with money.”

They are navigating a world their parents never had to navigate: a world faster, noisier, more uncertain, and more emotionally demanding.

Yet, in this chaos, a new financial identity is emerging:

- Quiet wealth

- Rational clarity

- Slow growth

- Emotional intelligence

- Systems over stress

- Consistency over intensity

- Simple principles over complex hacks

What matters now is not perfection; it is direction.

So, here are your final takeaways.

FINAL TAKEAWAYS (3–5 Key Insights)

- 1. Consistency is your greatest financial multiplier.

- Small monthly SIPs > big, inconsistent bursts. Clarity > motivation. Automation > willpower.

- 2. Emotional awareness is as important as financial knowledge.

- Money is deeply psychological. Understanding your triggers transforms your behavior. If this resonates, Explore: Emotional Spending Psychology and Financial Anxiety Is the Modern Disease.

- 3. Build systems, not promises.

- A dashboard. A 12 month SIP plan. A buffer fund. These will take you further than any financial hack. Explore: Your Financial System Needs a Dashboard — Not Just Dreams.

- 4. Combine Gen Z flexibility with young professional discipline.

- This creates the most resilient financial mindset: learn fast, adapt fast, save steadily, invest rationally, think long term.

- 5. Quiet, long term compounding creates real wealth.

- Not cryptocurrencies. Not FOMO trades. Not shortcuts. Explore: The Path to Real Wealth: Why Patience and Compounding Beat Shortcuts.

Frequently Asked Questions (FAQs)

- 1. How much should I save in my 20s?

- If you are 18–25 (Gen Z): Start with saving 10–20% of income. Even if it is small, consistency matters more than amount. If you are 26–35 (young professional): Aim for 20–30% depending on obligations.

- 2. How much should I invest every month?

- Begin with whatever you can automate. Gen Z: ₹500–₹2,000 SIP (Start early. Time is your superpower.) Young professionals: 10–25% of income into SIPs (Discipline is your superpower.) For guidance: Build a Strong SIP Habit and How to Choose the Right Mutual Fund.

- 3. Should I start a SIP or buy stocks?

- Start with SIPs. SIPs give stability. Stocks give volatility. Once your SIP base is strong, you can explore direct equities slowly and intentionally.

- 4. What’s the ideal emergency fund?

- Gen Z: 1–3 months of expenses (You are flexible and have fewer obligations.) Young professionals: 3–6 months of expenses (This protects you from layoffs, family needs, medical emergencies.) Explore: Emergency Fund Mastery.

- 5. How do I stop emotional spending?

- Use the 5 second question: “Am I buying this for comfort, identity, or need?” This breaks autopilot spending. Learn the emotional roots here: Emotional Spending Psychology.

- 6. Should I rent or buy a house in my 20s/30s?

- Renting makes sense initially if: your career is still growing, you plan to change cities, you want flexibility, or home prices are too high. Buying makes sense when: you want stability, you can afford a 20% down payment, EMI < 35% of your take home salary, and you plan to stay in the same city 7+ years.

- 7. Why does money give me anxiety?

- Because you were never taught money. You inherited fear, pressure, and uncertainty, not clarity. Start with: building a dashboard, having emergency savings, and automating SIPs. Explore more deeply: Financial Anxiety Is the Modern Disease.

- 8. Is side income necessary?

- In modern India, yes; not for luxury, but for stability. It creates: optionality, confidence, reduced job stress, faster savings, and higher long term safety. Explore: Side Income Ideas for 2025.

- 9. What’s the best investment for beginners?

- Simple answer: Nifty 50 or Nifty Next 50 Index Fund SIP. Low cost, long term compounding, minimal stress. Explore: Best Investment Options in India for 2025.

- 10. What’s the ONE thing I must start today?

- Start a SIP, even ₹500. The act of starting matters more than the amount.

THE FINAL WORD

If you feel behind, confused, inconsistent, or overwhelmed, breathe.

Every young Indian today is navigating a world full of noise, pressure, complexity, and emotional weight.

But you have clarity now.

You have a system now.

You have a philosophy now.

Your financial journey does not need urgency.

It needs presence.

It needs awareness.

It needs direction.

It needs calm action.

And you are ready.

Whenever you want…

If you have read this till the end, thank you❤️

With love,

Your Dearest Friend,

Chitraansh