CHAPTER I

The Emotional Magnetism: Why Gold and FDs are Psychological Anchors

There is a moment in every Indian household a quiet, almost ceremonial moment when someone opens the family locker.

You can picture it, can’t you?

The faint metallic smell.

The clink of gold bangles.

The perfectly folded FD receipts.

The weight of years, culture, and safety resting in a single drawer.

Gold and FDs are not just investments in India.

They are stories.

They are inheritance.

They are memory.

They are, for many of us, the first time we saw adults “doing money.”

Maybe you remember your mother’s hands counting gold as though she was weighing the family’s future.

Or your father’s quiet satisfaction when the bank officer handed him the FD certificate:

“Safe hai. Guaranteed hai.”

That moment stayed with you.

Even today, when you think of investing, a part of you returns to that locker to the familiarity, the certainty, the grounding of something that does not rise and fall with the chaos of the world.

And there is nothing irrational about this.

Your instincts are not silly or old fashioned.

They are human.

The truth is simple:

Gold and FDs represent emotional stability in a world that feels unstable.

They are not just financial assets, they are psychological anchors.

But here’s the deeper truth underlying this entire article:

What kept you safe during your parents’ generation may not be enough to secure your dreams in your lifetime.

Not because gold or FDs are “bad.”

But because your life is fundamentally different.

Your opportunities are bigger.

Your risks are larger.

Your financial needs are longer.

And the world moves faster than it ever did before.

1. The Emotional Blueprint: Understanding Your Safety Gravitation

Before you even think about equities, REITs, bonds, or anything that goes “up and down,” you first need to understand:

Your relationship with money is not logical, it is emotional.

You inherited this relationship long before you earned your first rupee.

You didn’t choose gold and FDs. They chose you.

Because for decades, Indian families lived through:

- unpredictable stock markets

- job insecurity

- limited access to financial education

- distrust in financial institutions

- big expenses like weddings, health emergencies, and schooling

- repeated economic uncertainty

So the brain adapted.

It formed a rule, quietly, subconsciously:

“If I want peace, I must choose safety.”

Gold and FDs became the emotional shorthand for that peace.

Loss Aversion: Why a 5% loss hurts more than a 20% gain feels good

Behavioral psychologists Daniel Kahneman and Amos Tversky proved something astonishing:

Losing money feels twice as painful as gaining the same amount feels good.

You might have felt this yourself.

A ₹10,000 loss in stocks keeps you awake.

But a ₹10,000 gain rarely creates the same intensity of joy.

This is why gold and FDs feel “right” even if their returns are low.

Certainty ≠ Growth

But the moment you choose certainty, you also accept something quietly:

Your money will stay safe, but it will not grow beyond a point.

Inflation will nibble at it.

Future goals will creep higher.

Life will demand more from you than slow, steady instruments can provide.

And you know this.

A part of you feels this gap, even if you can’t articulate it.

Sometimes it appears as financial anxiety like the nagging worry explored in Financial Anxiety Is The Modern Disease.

Sometimes it appears as the temptation to chase shortcuts like the emotional patterns described in Why You Keep Chasing Quick Profits.

You oscillate between:

- wanting total safety

- wanting fast gains

Gold and FDs represent the first.

Crypto, trading, and “stock tips” represent the second.

But your real path lies somewhere in between.

2. The Hidden Psychology: What Gold and FDs Symbolise (Beyond Returns)

Let’s take a deeper look at why these two instruments are so emotionally magnetic.

Gold = Emotional Security

Gold in India is:

- a symbol of purity

- a cultural asset

- a marriage currency

- a last resort emergency fund

- a store of generational wealth

But more than that:

Gold is reassurance in physical form.

You can hold it.

Touch it.

Lock it away.

Show it at family functions.

Convert it into money at any jeweller, anywhere.

For millions of Indians, gold is the feeling of safety, not the asset itself.

FDs = Mental Clarity

FDs are the opposite of chaos:

- fixed rate

- fixed tenure

- fixed maturity amount

You know exactly what you will get.

This predictability lowers anxiety and creates what psychologists call cognitive ease.

The brain loves cognitive ease.

When you choose an FD, you avoid:

- decision fatigue

- volatility stress

- confusion

- uncertainty

- “what if something goes wrong?” anxiety

In a world of information overload, FDs feel peaceful.

3. The Emotional Cost of Staying Only With Gold and FDs

Now, here’s where emotional clarity transforms into financial clarity:

Safety has a silent cost.

A cost you don’t see right away.

A cost you only feel years later when:

- inflation outruns your returns

- your savings feel “not enough”

- your goals move farther away

- you quietly panic about retirement

- you wonder if you are falling behind

- you feel pressure to take shortcuts later (like speculative trading)

This is the same internal cycle many readers experience in The Hidden Cost of Constant Hustle when doing the “safe thing” traps you in more work over time.

Let’s look at the math gently.

4. The Mathematical Reality: Why 5% Returns are Unsustainable

Imagine you put ₹10 lakh in an FD today at 6.5%.

After tax (assume 20%), your real return becomes around 5.2%.

Now consider inflation.

In 2025, realistic inflation for most Indian households is around 6–7%.

Which means:

Your FD is growing slower than your cost of living.

You feel safe emotionally but poorer mathematically.

Gold is similar.

Gold over the long term (not short term spikes):

~7–8% CAGR over 25 years.

But this is before:

- making charges

- GST

- converting costs

- storage costs

- liquidity discounts

After these adjustments, gold’s real return often becomes closer to 5–6%.

So again:

Gold protects purchasing power.

But it rarely creates wealth.

5. The Psychological Shift: Moving from “Safety First” to “Safety + Growth”

Chapter 1 is not about rejecting gold or FDs.

It’s about rebalancing the emotional equation you’ve been handed.

You don’t need to abandon safety.

You need to upgrade how you define it.

Real safety = A portfolio that beats inflation and supports your future life.

Not a locker full of slow growing assets.

The new generation needs:

- liquidity

- inflation beating growth

- diversified risk

- long term wealth creation

- stable cash flow

- exposure to new opportunities

- emotional peace

Gold and FDs give you emotional peace.

But only modern instruments give you future peace.

6. The New Financial Reality: Your Life is Different from Your Parents’

This is the emotional core of Chapter 1.

Your parents lived in:

- single income households

- low inflation periods

- stable job markets

- limited choices

- predictable lifestyles

- minimal lifestyle inflation

Your world is different:

- uncertain job cycles

- multiple career shifts

- medical inflation

- rising lifestyle costs

- longer retirement periods

- expensive education

- global opportunities

- market linked salaries

If your life is different, your investment strategy must be different too.

The fear of risk is valid.

But the fear of not growing enough is just as real a quiet fear most people never acknowledge until much later.

This article is here to make you conscious of that fear now while you still have time to act calmly, wisely, patiently.

7. The Gentle Truth: You are Evolving, Not Behind

If you have stayed only with gold and FDs so far…

If you have avoided stocks, mutual funds, bonds, or anything “risky”…

If you feel guilt or shame about not investing earlier…

Please hear this:

You are not behind. You were protecting yourself with the tools you understood.

This is not a failure.

It is the starting point of your evolution.

Growth begins the moment awareness opens.

And right now, you are opening that door.

CHAPTER II

The Modern Portfolio: Investment Options to Beat Inflation and Create Wealth in India

There comes a quiet turning point in every financial journey.

A moment when you realise,

“I know what I’m running away from…

but do I know what I’m running toward?”

Chapter 1 helped you gently understand why gold and FDs have been your emotional shelter for so long.

But clarity is never complete if it only tells you what you need to move away from.

Real transformation begins when you understand what lies ahead

calmly, patiently, one layer at a time.

This chapter is that layer.

Think of it not as a list of investments, but as a guided walk through a landscape you have avoided for years not because you lacked intelligence, but because you lacked emotional safety.

Today, we introduce that safety.

Not through promises.

Not through hype.

But through clarity and compassion.

1. The First Principle: Redefining Investment Risk

When you hear “equity,” “mutual fund,” or “market linked,” you might feel a tightening in your chest.

A slight unease.

A thought that whispers,

“Yeh sab risky hai.”

But have you ever paused to ask:

Risky to whom? Risky how? Risky when? Risky why?

Risk isn’t a character trait of an investment.

Risk is relational.

It depends on:

- your time horizon

- your life stage

- your income stability

- your goals

- your emotional temperament

- your knowledge level

What feels risky to a 25 year old may feel safe to a 45 year old.

What feels risky during volatility may feel stable over 10 years.

What feels risky when done randomly may feel predictable when done systematically.

This is the core of modern investing:

Risk is not the enemy.

Risk is simply the price you pay for growth.

And you get to choose how much you pay.

Everything beyond gold and FDs simply asks for one thing:

a slightly longer breath.

A little more patience.

A little more awareness.

And sometimes, just automation.

2. The New Landscape (A Calm, High Level Overview Before We Dive Deep)

You live in a world of far more options than your parents ever had.

Here’s the simple map:

A. Growth Focused Instruments

These can beat inflation significantly over long periods.

- Equity shares

- Equity mutual funds

- Index funds

- International equity funds

- Smallcap & midcap funds

- Sectoral funds (specialised)

B. Stability Focused Instruments

These offer moderate returns but higher predictability.

- Corporate bonds

- Government securities (G secs)

- Debt mutual funds

- NPS (mix of equity + debt)

- RBI Floating Rate Bonds

C. Income Focused Instruments

These give regular cash flow, not large growth.

- REITs

- InvITs

- Corporate bond ladders

- Monthly income schemes

D. Alternative Modern Options

Useful for diversification.

- Digital gold / SGBs

- Global ETFs

- Gold ETFs

- Multi asset funds

Let’s begin with the one that scares most people:

Equity.

3. Equity: The Most Misunderstood Source of Wealth for Indians

You’ve likely heard myths like:

- “Shares dangerous hote hain.”

- “Stock market is gambling.”

- “Safe log stocks mein nahi jaate.”

- “Money lose ho jayega.”

These are not facts.

These are traumatic memories from the 2000s when:

- there was no SEBI regulation

- no mutual fund transparency

- no digital platforms

- no SIP culture

- no free education

Today, India’s markets are among the world’s most regulated and transparent.

But the deeper truth is:

People don’t fear equity.

People fear uncertainty.

People fear loss.

People fear blame.

People fear making a wrong decision.

And that is perfectly human.

Let’s approach equity with the gentleness it deserves.

4. The Long Term Math: Why Equity Beats Inflation Consistently

Let’s begin with logic, not hype.

Indian Equities (30+ years)

Average long term return: ~12–14% CAGR

- A ₹10 lakh investment becomes ₹3.5–4 crore in 30 years.

- The same amount in FDs becomes ~₹55 lakh.

- The same in gold becomes ~₹1 crore.

This is not magic.

This is compounding.

And compounding rewards:

- patience

- discipline

- time

- consistency

Not intelligence.

Not luck.

Not timing.

This is why the true gateway to equity is not courage, it is habit.

Even if you invest ₹2,000–₹5,000 monthly, your long term trajectory can change.

If you want to explore the psychology of slow, patient growth, The Path to Real Wealth is a beautiful companion article.

5. Mutual Funds: Equity Made Emotionally Safer

Equity is like raw fire powerful but intimidating.

Mutual funds are like an induction stove safer, controlled, easier to use.

Here’s why mutual funds are perfect for beginners:

✔ Professional fund managers

✔ Diversification across many stocks

✔ Regulated, transparent NAVs

✔ SIP system reduces emotional stress

✔ Long term performance is consistent

✔ Auto debit makes discipline effortless

You don’t need to pick stocks.

You just pick a system.

If you ever felt confused choosing a fund, How to Choose the Right Mutual Fund can guide you step by step emotionally and practically.

6. Index Funds: Low Cost, High Confidence Investing

If mutual funds are safe, index funds are safest among equity options.

Why?

✔ There’s no fund manager risk

✔ They simply copy the index

✔ Costs are extremely low

✔ Long term returns match the market (12–14%)

Index funds are like saying:

“I don’t want to beat the market.

I just want to be the market.”

And that alone makes you wealthier than 93% of investors long term.

Index funds are the perfect emotional bridge between:

- fear and confidence

- confusion and clarity

- randomness and structure

7. Debt Mutual Funds: Stability without Stagnation

Debt funds sit between FDs and equity.

If FDs are emotional comfort…

And equity is emotional growth…

Debt funds are emotional balance.

Typical returns: 7–9%

Better than FDs.

Lower volatility than equity.

Tax efficient after 3 years.

Types include:

- Short term funds

- Liquid funds

- Corporate bond funds

- Banking & PSU funds

- Gilt funds

Debt funds are perfect for:

- emergency funds

- short term goals

- risk management

- predictable returns

If FDs make you feel “safe,” debt funds help you feel “safe and growing.”

8. Corporate Bonds and G Secs: The New Age of Safe Returns

In 2025, the bond market has transformed.

For the first time, retail investors can:

- buy G secs directly

- purchase corporate bonds online

- compare yields easily

- get predictable returns of 7–8.5%

- avoid bank middlemen

This opens a new world where you can build a personal fixed income ladder that grows faster than FDs.

Government bonds = ultra safe

Corporate bonds = moderately safe, higher returns

These instruments are stability pillars for a modern portfolio especially when combined with equity.

9. NPS: India’s Most Underrated Retirement Tool

NPS is a hybrid vehicle (equity + debt) designed for long term wealth building.

Its strength lies in:

- extremely low costs

- tax benefits (Section 80C + 80CCD)

- professional management

- compounding across decades

Typical long term return: 9–11%

It is ideal for:

- retirement planning

- long term security

- disciplined investing

NPS acts like a quiet, steady river in your financial landscape.

10. REITs and InvITs: Earn Monthly Income from Real Assets

If you’ve ever dreamed of owning real estate for rental income without crores of capital, without tenants, without paperwork REITs and InvITs are your modern solution.

REITs = Real Estate Investment Trusts

Office buildings, malls, commercial properties.

InvITs = Infrastructure Investment Trusts

Highways, power lines, telecom assets.

These offer:

- 8–12% yield

- quarterly or monthly payouts

- diversification beyond equity

- exposure to stable assets

They are perfect for:

- creating cash flow

- balancing risk

- adding real asset exposure

- long term stability

If equity feels “too fast” and FDs feel “too slow,” REITs feel “steady.”

11. International Funds: Global Exposure for a Changing World

Your career is global.

Your income sources are global.

Your economy is global.

Your aspirations are global.

Why shouldn’t your investments be?

International funds help you:

- diversify beyond India

- access tech giants (Google, Apple, Amazon)

- hedge against domestic uncertainty

- benefit from global growth

Typical long term return: 10–13%

Volatile short term, rewarding long term.

They’re not essential…

But they are powerful.

12. Multi Asset Funds: The Simplest Way to Spread Risk

These funds combine:

- equity

- debt

- gold

- sometimes REITs

All inside one instrument.

This gives:

- lower volatility

- smoother returns

- balanced growth

For beginners or emotionally cautious investors, multi asset funds are a perfect stepping stone.

13. A Calm, Comparative Summary: Aligning Investments with Your Emotions

Let’s pause the technicalities and return to how these options make you feel.

Because emotional alignment determines long term behavior.

| Investment | Emotional Vibe | Typical Return | Purpose |

|---|---|---|---|

| FDs | Peace, certainty | 5–7% | Safety, liquidity |

| Gold | Legacy, security | 6–8% | Inflation hedge |

| Debt Funds | Balance | 7–9% | Stability |

| Corporate Bonds | Predictability | 7–9% | Income planning |

| G Secs | Ultra safe | 6–7.5% | Capital preservation |

| Mutual Funds | Growth with calm | 10–14% | Wealth creation |

| Index Funds | Simplicity | 12–14% | Passive growth |

| Equity | High growth | 12–15% | Long term wealth |

| REITs / InvITs | Income clarity | 8–12% | Cash flow |

| International Funds | Global advantage | 10–13% | Diversification |

| Multi Asset Funds | Stability + growth | 8–11% | Emotional balance |

This table is not just numbers.

It’s a psychology map.

It helps you understand:

You don’t have to choose between safety and growth.

You can choose both in the right proportions.

This is the essence of modern investing.

14. Why This Exploration Matters Emotionally

You are not reading this to become a financial expert.

You are reading this because:

- you want freedom

- you want stability

- you want clarity

- you want to stop feeling behind

- you want to feel confident instead of confused

- you want a simple, wise path forward

And above all:

You want a relationship with money that feels calm, grounded, and empowering.

Almost no Indian ever receives this kind of emotional, psychological, and mathematical guidance.

You are doing rare work by learning this now.

Be proud of that.

15. Transition to Chapter 3: Building Your Personal Risk Return Map

Now that you understand:

- what exists

- how each option works

- how they differ from gold & FDs

- how they align emotionally

- and how they perform mathematically

The next question becomes:

“How do I choose what’s right for me?”

Not what’s right for others.

Not what seems trending.

Not what promises high returns.

But what fits your personality, your lifestyle, your temperament, your future.

(Read: Your Financial System Needs a Dashboard — Not Just Dreams.)

CHAPTER III

The Investor Identity: Aligning Financial Decisions with Your Emotional Blueprint

There is a quiet moment that comes to every investor a moment so subtle that most people miss it.

It happens when you move from thinking,

“What should I invest in?”

to

“Who am I as an investor?”

This moment is not intellectual.

It’s emotional.

It’s almost spiritual.

Because the greatest investment question is not:

- “Equity or debt?”

- “Mutual fund or FD?”

- “SIP or lump sum?”

The real question is:

What kind of life do you want to build?

And what kind of emotional world do you want to live in while building it?

1. Your Risk Identity: The Starting Point of All Wealth

Let’s begin with something simple but revolutionary:

Risk tolerance is not a number.

It is a story.

Your story.

Every financial choice you make

every hesitation, every decision, every delay, every sudden “shortcut” move

comes from your personal history with uncertainty.

You’re not irrational.

You are patterned.

Here’s the truth most financial advisors ignore:

You don’t invest in line with your goals.

You invest in line with your emotions.

And you cannot change your financial behavior

until you understand the emotional forces shaping it.

Let’s explore these forces gently, slowly, honestly.

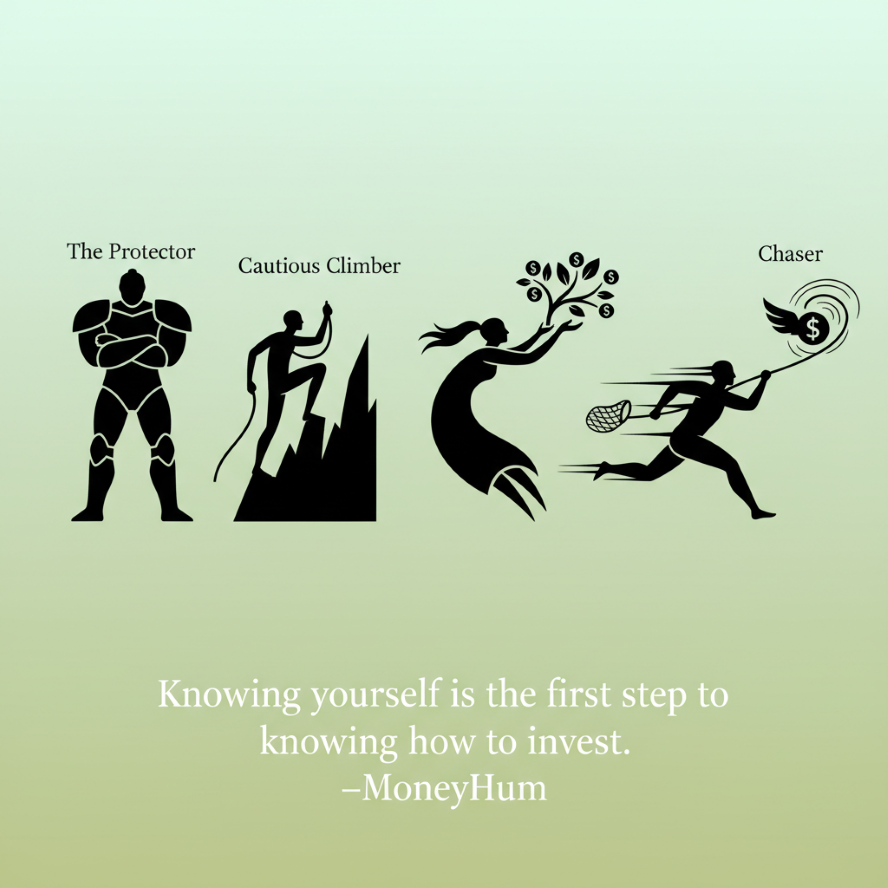

2. The Four Emotional Archetypes of Indian Investors

While every person is unique, most Indians fall into one of these emotional patterns:

A. The Protector (Safety First)

This is you if:

- volatility makes you anxious

- you prefer guarantees

- you check returns frequently

- you fear losing principal

- you want predictability over growth

Your early exposure to money possibly involved:

- parents who valued security

- fear of financial instability

- seeing others lose money

- being told “markets are risky”

Your core need: Emotional safety

Your risk tolerance: Low

Your vision: Slow and steady progression

B. The Cautious Climber (Balanced)

This is you if:

- you understand the need for growth

- you want safety but not stagnation

- you prefer hybrid or multi asset approaches

- you like diversification

- you invest but keep checking for reassurance

Your early exposure likely involved:

- mixed messages about money

- some fear, some confidence

- watching both success and failure around you

Your core need: Controlled growth

Your risk tolerance: Moderate

Your vision: Balance between today and tomorrow

C. The Growth Seeker (Long Term Mindset)

This is you if:

- you understand compounding

- you prefer equity for long term wealth

- volatility doesn’t shake you

- you invest regularly without panic

- you focus more on horizons than headlines

Your early exposure likely involved:

- access to financial education

- observing long term thinkers

- less fear of uncertainty

Your core need: Maximizing long term wealth

Your risk tolerance: Moderately high

Your vision: Future oriented

D. The Chaser (Impulse Driven)

This is you if:

- you get excited by fast returns

- you jump in during hype

- you exit during fear

- you follow tips, trends, “experts”

- you feel intense regret after losses

You might have experienced:

- pressure to grow quickly

- comparison with peers

- financial insecurity

- emotional triggers

- high expectations

- self judgment

Your core need: Validation, reassurance

Your risk tolerance: Varies emotionally driven

Your vision: Fast transformation (but inconsistent)

If you resonate with this archetype, the article Why You Keep Chasing Quick Profits will hit home in a healing way.

3. The Truth: None of These Archetypes Are “Wrong”

Money has always been taught as:

- rational

- numerical

- cold

- analytical

But money is not rational.

Money is emotional energy.

Each of these archetypes reflects not your weakness

but your emotional blueprint.

You can only build a powerful investment strategy

from the blueprint you actually have,

not the one you wish you had.

This is where asset allocation enters.

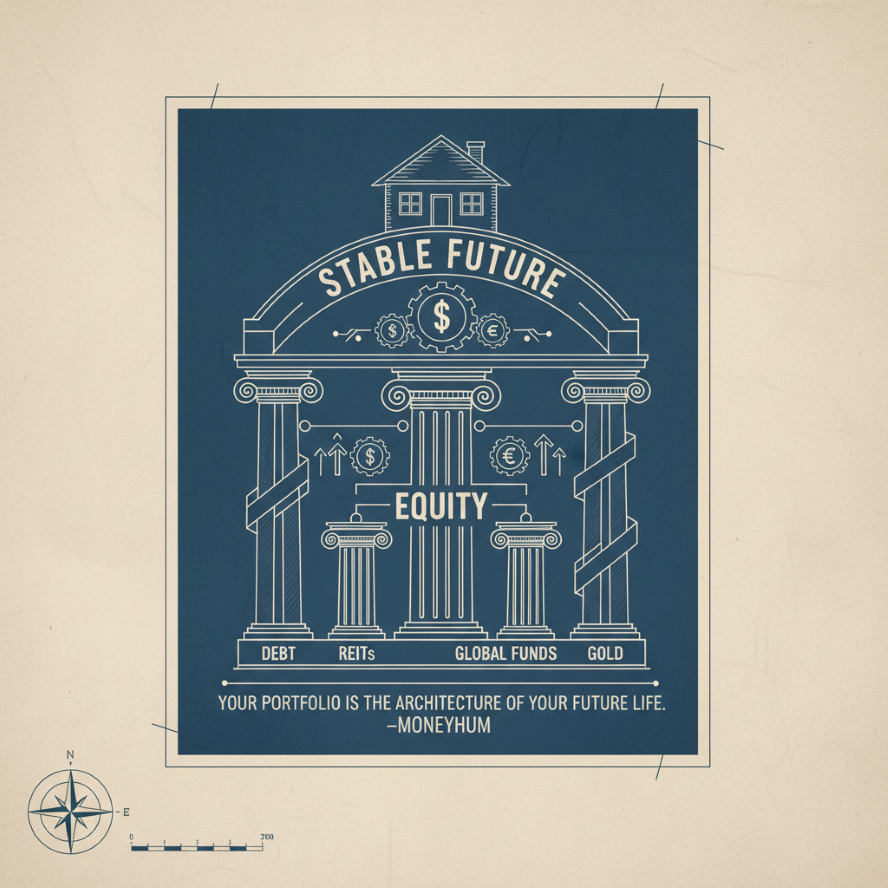

4. Asset Allocation: The Most Important Decision You Will Ever Make

People think wealth comes from:

- picking the best stock

- selecting the perfect fund

- timing the market

- choosing the right asset

But research repeatedly shows:

More than 90% of long term returns come from asset allocation not stock picking.

Asset allocation is simply:

How much of your money goes where.

Think of it like designing a house:

- equity = structure

- debt/bonds = foundation

- REITs = windows that bring light

- international funds = a second exit

- gold/SGBs = emergency staircase

When you choose the right mix, you create:

- emotional peace

- logical structure

- predictable progress

- future security

Let’s build your mix.

5. How to Build Your Personal Risk Return Map Step by Step

Here’s a calm, clear framework you can use:

STEP 1 Define Your Time Horizon

Your horizon determines your risk, not your age.

Short term (0–3 years)

- house down payment

- emergency fund

- near term expenses

Focus: Liquid funds, FDs, debt funds, SGBs, bonds

Medium term (3–7 years)

- car

- marriage

- major purchases

Focus: Hybrid funds, multi asset funds, balanced advantage funds

Long term (7+ years)

- financial freedom

- retirement

- wealth creation

Focus: Equity, index funds, NPS, REITs, global funds

This simple division will prevent 90% of financial stress.

STEP 2 Understand Your Emotional Recovery Speed

This is the real psychological trick.

Ask yourself:

“If my investment drops 10%,

how long will it take me to feel emotionally normal again?”

If your recovery time is:

- Less than a week → High risk tolerance

- 1–3 weeks → Moderate

- 1–3 months → Low

- More than 3 months → Very low

Your recovery speed defines your allocation.

This is more accurate than any questionnaire.

STEP 3 Choose Your Ideal Allocation (Emotion + Logic Combined)

Here are the three calmest, most realistic blends:

Option A Safety First Portfolio (Low Risk)

Best for:

The Protector

People anxious about volatility

Short term goals

Allocation:

- 60–70% Debt (FDs, debt funds, bonds)

- 10–20% Equity (index funds preferred)

- 10–15% Gold (SGBs)

- 5–10% REITs

Outcome:

- Low volatility

- Predictability

- Moderate returns (7–9%)

Emotionally:

Peace with steady growth.

Option B Balanced Portfolio (Moderate Risk)

Best for:

The Cautious Climber

People with 5–10 year horizons

Those who want safety + growth

Allocation:

- 40–50% Equity

- 30–40% Debt

- 10% Gold

- 10% REITs / International

Outcome:

- Higher stability

- Growth of 10–11% long term

Emotionally:

Confidence with fewer shocks.

Option C Growth Portfolio (Higher Risk)

Best for:

The Growth Seeker

People with 10–20 year horizons

Those who want maximised wealth

Allocation:

- 60–75% Equity

- 15–25% Debt

- 5–10% Gold

- 5–10% International

Outcome:

- Strong compounding (12–14%)

- Higher volatility, higher reward

Emotionally:

Steady long term conviction.

6. The Most Important Rule: Risk Should Never Exceed Your Emotional Capacity

Even if you logically understand equity…

Even if everyone around you is investing…

Even if the market is booming…

You should never invest more in equity

than your emotions can comfortably handle.

Because when you exceed your emotional threshold:

- you panic

- you withdraw at losses

- you blame yourself

- you carry shame

- you make reactive decisions

- you break the cycle of compounding

This is not worth it.

A portfolio is like a home.

It should feel safe, not stressful.

7. The Emotional Discipline Framework: Staying Consistent Without Anxiety

Even after choosing the right allocation, most people struggle with follow through.

Not because they lack discipline,

but because they lack emotional automation.

Here’s a system that MoneyHum readers love.

A. Automate Your SIPs

Automation removes:

- hesitation

- procrastination

- overthinking

- emotional swings

If you want a simple beginner friendly plan, see:

Build a Strong SIP Habit: 12-Month Plan.

B. Create a Monthly “Check In,” Not a Daily Monitoring Habit

Checking investments daily activates:

- cortisol

- fear

- impulsive responses

- loss aversion

But monthly check ins create:

- emotional distance

- clarity

- steadiness

- long term perspective

C. Use the “Rule of Separation”

Separate:

- emergency funds

- investments

- short term needs

This prevents emotional mixing the cause of most panic withdrawals.

D. Build a Financial Dashboard

This is not just a spreadsheet.

It is self awareness in data form.

You understand:

- cash flow

- liquidity

- long term projections

- net worth trends

As explained beautifully in:

Your Financial System Needs a Dashboard — Not Just Dreams

E. Don’t Compare Yourself

Comparison is the biggest destroyer of financial peace.

Someone started early.

Someone earned more.

Someone took more risk.

Someone had a breakout year.

This has nothing to do with you.

You are on your path.

Your pace is enough.

Always.

8. The Inner Work: Understanding Your Real Financial Fears

You cannot build a calm investment life

without naming what scares you.

Most investors fear money for reasons unrelated to money:

- fear of failure

- fear of losing stability

- fear of disappointing family

- fear of not knowing enough

- fear of repeating someone else’s mistakes

- fear of being judged

- fear of “not being good with money”

These fears quietly shape portfolios.

This is why real risk management begins with emotional healing, not numerical calculations.

If you want to explore this further,

Financial Anxiety Is the Modern Disease

is a deeply grounding companion piece.

9. The Quiet Power of Diversification: Healing Through Structure

Diversification is not just a strategy.

It is emotional therapy.

It tells your nervous system:

- “Even if one asset falls, others will support you.”

- “Even if there is volatility, your foundation is safe.”

- “Even if markets crash, your goals are protected.”

Diversification is like having multiple pillars under your life.

You don’t lean on just one idea.

You spread your emotional risk.

10. A Gentle Reminder: You Are Allowed to Evolve

Many readers tell me they feel ashamed about:

- not investing earlier

- not knowing enough

- avoiding equity

- staying only with gold/FDs

- losing money in quick profit attempts

- being fearful

- being inconsistent

Let me tell you something softly:

There is no shame in protecting yourself

with the tools you understood at the time.

Growth is not about perfection.

It is about awareness + consistency.

You are evolving.

That is enough.

CHAPTER IV

The 2025 Blueprint: Building a Calm and Confident Diversified Portfolio

There’s a moment a quietly powerful moment when awareness turns into strategy.

Where everything you learned about:

- your emotions

- your fears

- your patterns

- your aspirations

- your sensitivity to uncertainty

- your long term vision

finally shapes something practical, something real, something you can execute.

That moment is here.

This chapter is not about giving you complicated formulas.

It’s about giving you a personal blueprint something you can follow with calm confidence, not anxiety.

Think of this chapter as the bridge between:

- your psychology and your portfolio,

- your emotion and your action,

- your desire for peace and your need for growth.

Let’s build your 2025 blueprint together.

Slowly.

Thoughtfully.

Humanly.

1. The Philosophy of a Modern Indian Portfolio (2025)

Before telling you where to invest, I want you to understand why this blueprint works.

Here’s the truth:

The strongest portfolios are not the ones with the highest returns.

They are the ones you can stick with for decades without emotional collapse.

Your blueprint must check six emotional boxes:

- Will this portfolio let you sleep peacefully?

- Will this portfolio grow despite short term volatility?

- Will this portfolio protect you from inflation?

- Will this portfolio give you confidence during crashes?

- Will this portfolio require minimal monitoring?

- Will this portfolio stay stable even when life becomes unstable?

If an investment strategy fails ANY of these questions, it will not last because you’ll abandon it at the worst possible moment.

A successful portfolio is not built on intelligence.

It is built on emotional sustainability.

This is why your 2025 blueprint blends:

- equity (for growth)

- debt (for stability)

- gold (for protection)

- REITs (for income)

- international funds (for diversification)

Gold and FDs still have a place in your blueprint not as the center, but as the foundation.

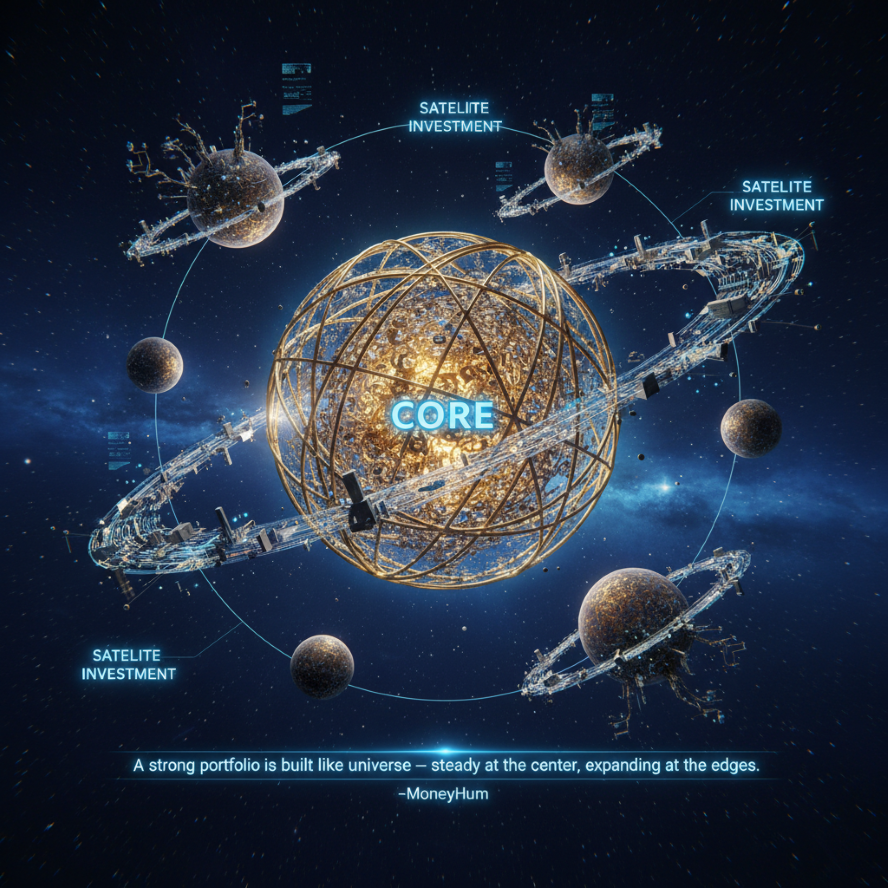

2. The 2025 “Core & Satellite” Framework (Your Portfolio’s Architecture)

This framework is elegant, simple, psychologically stable and powerful.

CORE = 80–90% of your portfolio

Your long term pillars.

Steady, predictable, diversified.

SATELLITE = 10–20% of your portfolio

Your growth boosters.

Small, intentional bets.

This system ensures:

- low stress

- high growth

- controlled risk

- long term consistency

Let’s build each part.

3. Your CORE Portfolio (The Unshakeable 80–90%)

This part is designed to survive:

- crashes

- fear

- elections

- inflation

- economic downturns

- uncertainty

Your CORE is where simplicity meets strength.

Here’s the ideal 2025 Core Allocation:

1. Equity (40–55% of total portfolio)

Vehicle:

- Index Funds (Nifty 50 / Sensex)

- Large cap Funds

- ELSS (optional, for tax)

Why this matters emotionally:

- You avoid the stress of picking stocks.

- You match India’s economic growth.

- You experience fewer shocks than midcap/smallcap.

- You build long term wealth quietly.

Why this matters mathematically:

- 12–14% CAGR over decades

- Low cost → higher compounding

- Most stable form of equity investing

If you want guidance choosing funds, you can revisit

How to Choose the Right Mutual Fund.

2. Debt (25–35%)

Vehicle:

- Corporate Bond Funds

- Gilt Funds

- Banking & PSU Funds

- Short term Debt Funds

- FDs (for emotional safety)

- RBI Bonds

- Government Securities

Why this matters emotionally:

- Smoothes volatility

- Keeps your heart rate normal

- Makes market crashes bearable

- Ensures liquidity

Why this matters mathematically:

- 7–9% returns on average

- Tax efficient after 3 years

- Reduces overall risk

Debt is your portfolio’s shock absorber.

3. Gold (10–15%)

Vehicle:

- Sovereign Gold Bonds (ideal)

- Gold ETFs

- Digital Gold

Why this matters emotionally:

- A sense of tradition

- A feeling of comfort

- A hedge against uncertainty

Why this matters mathematically:

- Long term return: ~6–8%

- Hedge against currency risk

- Counterbalance during market stress

Gold is not a wealth creator.

Gold is insurance for the soul.

4. REITs / InvITs (5–10%)

Vehicle:

- Embassy REIT

- Mindspace REIT

- Brookfield REIT

- PowerGrid InvIT

- IRB InvIT

Why this matters emotionally:

- Gives a sense of real estate exposure

- Provides stable cash flow

- Feels “real” compared to market assets

Why this matters mathematically:

- 8–12% yield

- Low correlation with equity

- Excellent long term stabiliser

For many people, REITs replace the emotional need to “own property.”

5. International Funds (5–10%)

Vehicle:

- US Index Funds

- Nasdaq 100 Funds

- Global ETFs

Why this matters emotionally:

- Makes you feel globally secure

- Reduces dependence on domestic conditions

- Gives access to the world’s top innovators

Why this matters mathematically:

- Strong long term returns

- Dollar appreciation adds growth

- Smooths long term volatility

International funds are your global safety net.

4. Your SATELLITE Portfolio (Intentional 10–20%)

This section is your controlled space for exploration.

The purpose of satellite investing is NOT to chase fast returns.

It is to express your long term convictions in a calm, structured way.

Your satellite portfolio can include:

- Midcap Funds

- Smallcap Funds

- Tech/IT Sectoral Funds

- Thematic Funds

- International themes (AI, EVs, Green Energy)

- Factor based index funds (Momentum, Value, Quality)

The key rule:

Satellite investments must NEVER exceed your emotional capacity.

Most Indians lose money not because of bad funds,

but because they over allocate to high risk segments.

Your satellite portfolio should be like spice not the main meal.

5. How Much Should You Allocate? Three Blueprints Based on Your Risk Identity

We now combine everything from Chapter 3 with Chapter 4.

Choose the blueprint that resonates emotionally.

A. Stability Blueprint (Low Risk)

Ideal for:

Protectors, FD lovers, people uncomfortable with volatility, new investors.

Allocation:

- 30–35% Equity

- 45–55% Debt

- 10–15% Gold

- 5–10% REITs

- Optional 5% International

Expected Long term Return: ~8–10%

Emotional Experience: Calm, steady, minimal stress

This blueprint is perfect if you value:

- sleep

- stability

- predictability

- low anxiety

B. Balanced Blueprint (Moderate Risk)

Ideal for:

Cautious Climbers, most working professionals, families, early planners.

Allocation:

- 45–55% Equity

- 25–35% Debt

- 10% Gold

- 5–10% REITs

- 5–10% International

Expected Long term Return: ~10–12%

Emotional Experience: Confidence with manageable ups and downs

This is the most realistic blueprint for the modern Indian in 2025.

C. Growth Blueprint (Higher Risk)

Ideal for:

Growth Seekers, long term thinkers, people with 10+ year horizons.

Allocation:

- 60–75% Equity

- 15–25% Debt

- 5–10% Gold

- 5–10% International

- Optional 5% REITs

Expected Long term Return: ~12–14%

Emotional Experience: Periodic volatility, strong long term outcomes

This blueprint builds wealth quietly but powerfully.

6. Your Personal 2025 Investment Plan (A Gentle, Monthly System)

Here’s the simplest, emotionally sustainable, beginner proof plan you can follow:

STEP 1 Invest 60–70% through SIPs

Automate everything:

- Index funds

- Balanced advantage funds

- Bond funds

- International index funds

- ELSS

- Gold (if using Gold ETFs)

SIPs reduce:

- fear

- emotional reactions

- timing mistakes

- decision fatigue

They increase:

- discipline

- consistency

- long term returns

If you need a 12 month hand holding SOP, follow:

STEP 2 Invest 20–30% through quarterly lump sums

For:

- REITs

- InvITs

- SGBs

- International funds

- Short term opportunities

Quarterly investing aligns beautifully with India’s market cycles.

STEP 3 Review your portfolio only 2–3 times a year

Not monthly.

Not weekly.

Never daily.

Review:

- asset allocation

- SIP continuation

- debt vs equity balance

- rebalancing needs

This protects you from emotional impulsiveness.

STEP 4 Rebalance once a year (non negotiable)

If equity grows too much, shift some into debt.

If equity falls too much, buy more to rebalance.

Rebalancing:

- reduces risk

- increases returns

- stabilises emotions

It is the most underrated superpower in investing.

STEP 5 Map every investment to a goal

This creates emotional clarity.

Example:

- Education → Balanced funds

- House down payment → Debt funds

- Marriage → Hybrid funds

- Retirement → Equity + NPS

- Travel → Liquid + gold

- Wealth creation → Index funds

When each rupee has a purpose, you avoid fear driven decisions.

7. A Gentle Warning: What NOT to Do in 2025

A strong portfolio is like a disciplined life it is often strengthened by what you avoid, not what you add.

Avoid these traps:

1. Over allocating to smallcaps or midcaps

These funds grow fast, but fall fast.

Keep them in the satellite portfolio only.

2. Buying sectoral/thematic funds without conviction

AI, Pharma, Banking, EV…

These are powerful themes but highly volatile.

Use them sparingly.

3. Mixing short term money with long term portfolios

This creates:

- panic

- poor withdrawals

- damaged compounding

Always separate emergency funds.

Read:

if you want clarity.

4. Constantly checking NAVs and stock prices

This destroys emotional stability.

Stick to your monthly and quarterly schedule.

5. Comparing your returns with others

Comparison = self doubt

Self doubt = emotional decisions

Emotional decisions = losses

You are building your life.

Not theirs.

8. The Emotional Transformation: From Fear → Clarity → Confidence → Freedom

A powerful portfolio does something more than grow your money.

It grows your identity.

As your investments become:

- structured

- automated

- stable

- diversified

- goal aligned

You experience a shift inside:

✔ Fewer doubts

✔ More stability

✔ Less emotional noise

✔ More long term thinking

✔ Less temptation

✔ More patience

✔ Less panic

✔ More self respect

You start behaving like a long term wealth builder.

Not because you forced yourself.

But because your system began supporting your psychology.

This is the heart of MoneyHum’s philosophy.

Money becomes:

- calm

- predictable

- supportive

- healing

Not chaotic.

Not confusing.

Not overwhelming.

CHAPTER V

Mastering Investment Behavior: How to Build Emotional Strength During Market Uncertainty

There is a truth about investing that very few people speak openly about:

Making money is not the hardest part.

Staying invested is.

Anyone can:

- open a demat account,

- start a SIP,

- buy a mutual fund,

- follow a blueprint…

But the real battle begins after you invest.

Not in the markets.

But in your mind.

Your biggest opponent is not volatility.

Your biggest opponent is:

- fear,

- self doubt,

- anxiety,

- impatience,

- comparison,

- regret,

- shame,

- and the quiet pressure of “Am I doing enough?”

This chapter is about winning this inner war gently, daily, humanly.

Because wealth is not built in bull markets.

It is built in the moments when:

- the NAV falls

- the graph turns red

- the news sounds frightening

- and your brain whispers, “Maybe I should exit… just to be safe.”

Your long term wealth is determined entirely by how you behave in these moments.

Let’s build the emotional mastery you need to stay invested with calmness, clarity, and quiet conviction.

1. The Invisible Enemy: Your Nervous System, Not the Market

You think you fear market crashes.

But you don’t.

What you actually fear is:

- losing control

- uncertainty

- regret

- shame

- “what will people say?”

- your family’s judgment

- the pain of being wrong

- the discomfort of not knowing “how long it will last”

Your nervous system reacts to volatility

the same way it reacts to danger.

Your heart beats faster.

You check your phone repeatedly.

You imagine worst case scenarios.

You catastrophize (“What if I lose everything?”).

You want to act immediately sell, withdraw, escape.

This is called:

Fight, flight, or freeze the body’s biological response to uncertainty.

It is not stupidity.

It is survival instinct.

The problem is:

the market is not a tiger.

And your portfolio’s temporary dip is not death.

But your body doesn’t know that.

This is why emotional investing feels so overwhelming.

Your biology is fighting your strategy.

Until you understand this, you will always struggle.

Let’s understand it with compassion.

2. Why Market Crashes Hurt You More Than You Think

Behavioral psychology explains that humans experience:

Loss Aversion

Losing ₹10,000 hurts more than gaining ₹10,000 feels good.

Recency Bias

What just happened feels like the whole story.

Negative Confirmation Bias

Your mind looks for proof that your fears are correct.

Narrative Fallacy

You connect unrelated events into a story of doom.

Suddenly, a market correction feels like:

- “This time it’s different.”

- “I should have sold earlier.”

- “I’m not good at this.”

- “I’ll lose everything.”

The market didn’t scare you.

Your own thoughts did.

This is why every crash feels like the end of the world

even though history shows it never is.

Let’s take a grounding pause.

3. The Math of Crashes (And Why You Are Safer Than You Feel)

Let’s look at history with humility:

Nifty 50 data (1994–2024):

- 9 major crashes

- 100% recovery from every crash

- New all time highs after each recovery

- Long term CAGR: ~12–14%

Sensex from 1979–2024:

- Starting at: 100 points

- Today: 70,000+ points

That’s 700x growth, despite:

- wars

- elections

- recessions

- pandemics

- scams

- inflation

- global crises

- economic shocks

Every crash felt like the end.

Every recovery felt impossible.

Every new high felt unbelievable.

But it happened anyway.

Because markets don’t follow emotions.

They follow earnings, innovation, population growth, consumption, and human progress.

Your fear is temporary.

The market’s growth is permanent.

This truth changes your life

only when you absorb it emotionally, not just intellectually.

4. The Three Types of Market Pain and How to Handle Each One

Let’s differentiate the kinds of stress you feel.

A. Short Term Volatility (Daily/Weekly Noise)

This is the everyday up down movement.

Emotional reaction: Anxiety, irritation, distraction

Reality: Meaningless

What to do:

- Ignore entirely

- Never check daily

- Focus on SIP continuity

- Use this time to work, not worry

Short term volatility is just the market breathing.

B. Corrections (Market falls 10–20%)

Corrections happen every 12–18 months.

Emotional reaction: Fear, doubt, second guessing

Reality: Healthy. Necessary. Normal.

Corrections:

- remove overvaluation

- strengthen long term returns

- create buying opportunities

What to do:

- Continue SIPs

- Avoid headlines

- Don’t change asset allocation

- Don’t check returns

Corrections are tuition fees for long term wealth.

C. Crashes (Market falls 30–50%)

Extremely rare.

But emotionally intense.

Emotional reaction: Panic, “everything is collapsing,” urge to sell

Reality: The best wealth building period (in hindsight).

Crash examples:

- 2000 dot com

- 2008 global crisis

- 2020 Covid crash

Every crash recovered.

Every recovery created new millionaires.

What to do:

- Pause news consumption

- Don’t change anything

- Keep SIPs running

- Continue rebalancing

- Remember your horizon (>10 years)

Crashes are not danger.

Crashes are distorted mirrors of your fear.

Your real strength is in not reacting.

5. The Emotional Tools You Must Master to Survive and Thrive

Here is where psychology becomes your real investment edge.

A. Adopt “The 20 Year Rule”

Whenever you feel panic, ask:

“Will this matter 20 years from now?”

The answer is always: No.

This single question kills:

- panic

- emotional decisions

- urge to sell

- sense of urgency

B. Emotional Diversification

Diversification is not just finances it is emotional safety.

Your mind feels calmer when your portfolio has:

- equity for growth

- debt for stability

- gold for protection

- REITs for income

- global funds for diversification

Suddenly, one red number does not define your mood.

C. Build a “Crash Protocol”

A list you revisit during panic:

- Do not check NAV

- Do not sell anything

- Continue SIPs

- Journal your thoughts

- Remind yourself of your horizon

- Rebalance only after stability returns

- Talk to someone calm

This is emotional first aid.

D. Use “Distance” as a tool

Distance reduces emotional reactivity.

Take 48 hours before making any financial decision.

This gap:

- calms the nervous system

- reduces cortisol

- allows logic to return

Most bad decisions happen within 30 minutes of anxiety.

A 48 hour rule can save decades of compounding.

E. Separate Identity from Outcome

You didn’t lose money.

Your investment value temporarily decreased.

This is not your failure.

It is the market’s cycle.

Do not attach self worth to your portfolio.

This is a psychological trap many Indians fall into because we grew up with phrases like:

- “Be responsible.”

- “Don’t make mistakes.”

- “Money shouldn’t be lost.”

This creates lifelong guilt around volatility.

Release it.

6. The Power of Staying Consistent (Why Time > Timing)

Let’s say three people invest ₹10,000/month for 30 years:

Person A: Perfect Timer

Magically invests only at market lows

Final Wealth: ₹18–20 crore

Person B: Regular SIP Investor

Invests every month regardless

Final Wealth: ₹16–18 crore

Person C: Panic Seller

Stops SIPs during crashes

Final Wealth: ₹8–10 crore

What this proves:

Being consistent is almost as powerful as perfect timing.

And far more powerful than emotional reactivity.

Your biggest wealth multiplier is not finding the right moment.

It is not stopping.

This is why crashes are not your enemy.

Breaking your discipline is.

7. The Psychology of Boredom: The Silent Killer of Wealth

After a few years, your portfolio becomes… boring.

Consistent SIPs.

Slow compounding.

Same allocations.

Your brain starts craving stimulation:

- “Should I try crypto?”

- “Smallcaps gave 60% return last year.”

- “Tech IPOs are booming.”

- “My friend doubled his money.”

This is a trap.

Investing is not supposed to entertain you.

It is supposed to free you.

If you want excitement,

find it in your career, skills, creativity, relationships, fitness, music, travel

not in your portfolio.

Your portfolio should be dull.

Emotionally quiet.

Predictable.

Boredom is the birthplace of wealth.

8. How to Silence Financial Anxiety (The Inner Techniques)

Let’s talk about the softer side your inner world.

Because even with the best strategy,

an anxious mind can sabotage everything.

Here are the practices that MoneyHum readers swear by:

A. Write a “Letter to Your Future Self”

Explain:

- why you are investing

- what your long term vision is

- why short term fear doesn’t matter

Read this during volatility.

B. Turn Off Notifications

Silence:

- stock apps

- financial news alerts

- market tickers

Your mind becomes peaceful instantly.

C. Use Affirmations That Ground You

Not cheesy ones.

Real ones:

- “Temporary dips are not permanent loss.”

- “I invest for decades, not days.”

- “My strategy is stronger than my fear.”

- “Volatility is the price of growth.”

- “I choose discipline over impulse.”

Repeat them during stressful periods.

D. Track Your Net Worth Only Twice a Year

This prevents:

- emotional instability

- overreaction

- micro managing

- panic decisions

E. Practice Emotional Budgeting

This means:

- consciously deciding how much “worry time” you allow

- limiting exposure to fear driven content

- setting boundaries around money conversations

- understanding which topics trigger you

Emotional budgeting protects your peace.

9. The Hardest Part of Investing: Doing Nothing

Let’s take a moment to sit with this truth:

Most of your wealth will come from the years when you did… nothing.

You didn’t:

- predict the market

- chase the news

- sell on fear

- jump on trends

- overthink

- check NAV daily

You simply stayed.

Staying invested feels passive,

but it is the most active form of emotional strength.

It requires:

- maturity

- patience

- emotional detachment

- trust

- discipline

- inner clarity

You don’t control returns.

You control behavior.

And behavior controls returns.

10. What It Means to Become a “Calm Investor”

A calm investor is not someone who knows everything.

A calm investor is someone who knows enough to stop panicking.

You become calm when:

- you trust your system

- you trust your horizon

- you trust diversification

- you trust your emotional boundaries

- you trust compounding

You become calm when you realise:

The market has never punished anyone who stayed.

It has only punished those who ran.

Calm investors quietly outperform anxious investors by a huge margin.

Because they let time work for them.

CHAPTER VI

The Long Game: Connecting Wealth Creation with Identity and Future Freedom

Every financial journey eventually arrives at a crossroads where the numbers stop being numbers.

Where CAGR turns into clarity.

Where SIPs turn into self belief.

Where asset allocation turns into emotional alignment.

Where compounding turns into identity.

You began this journey wanting investment options beyond gold and FDs.

But somewhere along the way, something deeper happened something almost invisible:

You started becoming someone else.

Someone calmer.

Someone more aware.

Someone less impulsive.

Someone more grounded.

Someone who sees money not as noise, but as a narrative.

This final chapter is about that transformation.

Not the transformation of your bank balance

but the transformation of you.

This is the long game.

Not just wealth creation.

But self creation.

1. Wealth Is Not Money. Wealth Is Identity.

Let’s begin with the truth you may have always known subconsciously:

You don’t just want money.

You want who money allows you to become.

Ask people what they want, and they will say:

- “Financial freedom.”

- “Enough money to retire.”

- “A comfortable life.”

- “Security for family.”

But beneath these desires lie deeper ones:

- the freedom to choose

- the ability to say no

- the dignity of self reliance

- the quiet confidence that comes from abundance

- the emotional safety of not being one emergency away from collapse

- the spiritual relief of not living in survival mode

Wealth is not about lakhs or crores.

Wealth is the ability to live without fear.

This journey the one you started when you moved beyond gold and FDs is about becoming a person who:

- trusts themselves with money

- thinks long term

- behaves with emotional maturity

- resists shortcuts

- embraces patience

- grows gently but steadily

- handles uncertainty with grace

This identity is far more valuable than any investment.

Because:

Your portfolio grows only as fast as you grow.

And you ARE growing.

2. Money Maturity = Life Maturity

There is a quiet parallel between emotional maturity and financial maturity.

Let’s explore it gently.

Emotionally immature people:

- seek instant gratification

- get triggered easily

- act impulsively

- compare constantly

- fear mistakes

- seek shortcuts

- avoid long term commitments

Financially immature investors:

- chase quick profits

- panic during volatility

- follow tips

- buy high, sell low

- abandon SIPs after short term losses

- look for guaranteed gains

- feel shame around mistakes

Notice the pattern?

Now look at the opposite.

Emotionally mature people:

- stay steady

- think long term

- act with intention

- embrace patience

- observe without reacting

- take responsibility

- trust the process

Financially mature investors:

- rely on asset allocation

- invest consistently

- stay calm during crashes

- avoid speculation

- re evaluate but don’t overreact

- understand cycles

- trust compounding

In both cases, maturity is not perfection.

It is simply knowing when to pause.

This journey these last six chapters have been about learning to pause.

- Pause before fear.

- Pause before impulse.

- Pause before comparison.

- Pause before regret.

- Pause before decisions.

In that pause lies everything you’ve been looking for.

3. The Psychology of the Future Self (Your Most Important Relationship)

Let’s talk about the person who will receive the results of your investing:

Your Future Self.

This person:

- wakes up without financial fear

- feels secure and peaceful

- owns their time

- has freedom of choices

- is not terrified of emergencies

- does not depend on uncertain outcomes

- lives with quiet dignity

- treats money with respect, not desperation

The question is:

How often do you think about them?

And how often do you betray them?**

Every time you:

- stop SIPs

- chase shortcuts

- panic sell

- avoid learning

- delay investing

- overspend emotionally

…you are not sabotaging your present.

You are sabotaging your future self.

This is why behavioral psychologists say:

The greatest act of self love is long term investing.

Because you are telling your future self:

“I won’t abandon you. I won’t leave you unprepared.”

Gold and FDs may protect your past.

But disciplined investing protects your future.

And your future matters.

4. Why You Don’t Need to Be Perfect You Just Need to Be Consistent

Here is a truth that should dissolve all pressure:

You don’t need perfect timing, perfect funds, perfect strategies.

You only need consistency.**

Let’s imagine three alternate versions of you:

1. “Perfect Investor You”

- invests at the bottom of every crash

- picks the best funds

- times everything flawlessly

- never panics

Outcome: ₹17–20 crore over 30 years.

Unrealistic.

Not you.

Not anyone.

2. “Average Consistent You”

- invests every month

- sticks to asset allocation

- ignores daily news

- stays invested through everything

- rebalances yearly

Outcome: ₹15–18 crore.

Extremely realistic.

Extremely achievable.

Extremely powerful.

3. “Emotional You”

- stops SIPs during fear

- exits during corrections

- buys during hype

- never stays long enough

- switches funds frequently

Outcome: ₹6–10 crore.

This is the actual difference:

The gap between “perfect” and “consistent”

is smaller than the gap between “consistent” and “emotional.”

This is why your emotional discipline

is more important than your financial literacy.

Not because markets punish you.

But because your behavior shapes your outcome.

Consistency is your real compounding engine.

5. Identity Shift: Becoming ‘The Long Term Investor’

At some point, your investing journey becomes less about money

and more about becoming a certain type of person.

Your identity shifts.

You move from:

- “I hope this works” to

- “I trust my system.”

You move from:

- “Is the market up today?” to

- “I don’t need to check.”

You move from:

- “What if it crashes?” to

- “Crashes are opportunities.”

You move from:

- “I feel scared.” to

- “I feel steady.”

This shift is subtle

but life changing.

It’s the moment you stop being reactive

and start being rooted.

You become someone your future self will thank endlessly.

6. The Spiritual Side of Investing (Yes, It Exists)

This will sound unusual,

but investing has a spiritual dimension.

Think about it:

Investing forces you to trust what you cannot see yet.

That’s faith.

Investing makes you patient without immediate reward.

That’s discipline.

Investing teaches acceptance of things outside your control.

That’s surrender.

Investing rewards slow, consistent effort.

That’s karma.

Investing detaches your happiness from temporary outcomes.

That’s equanimity.

Investing teaches you to play the long game.

That’s wisdom.

In this way,

your portfolio is not just an economic tool.

It is a spiritual teacher.

It teaches you:

- humility

- patience

- detachment

- resilience

- consistency

- emotional regulation

The market is not your enemy.

And it is not your savior.

It is your mirror.

It reflects your inner world back to you.

7. The Five Laws of Long Term Wealth (Your Life Compass)

Let’s distill everything into five simple principles.

These are the laws that will guide your financial life for decades.

LAW 1: The earlier you start, the easier your life becomes.

Time multiplies even small investments.

LAW 2: Wealth comes from behavior, not knowledge.

Discipline > intelligence.

Consistency > timing.

Patience > perfection.

LAW 3: Diversification protects your peace.

If one thing fails, others support you.

Emotional safety = long term compounding.

LAW 4: Crashes are temporary. Growth is permanent.

Every downturn becomes an upturn.

Every fear becomes a forgotten memory.

LAW 5: Your future self is your most important financial responsibility.

You are not just investing money.

You are investing in the person you want to be.

8. Your Financial Journey Has Only One Goal: Peace

Not returns.

Not wealth.

Not bragging rights.

Not beating inflation.

Not beating the market.

Peace.

Peace in:

- retirement

- emergencies

- family decisions

- career choices

- daily life

- long term planning

- unexpected situations

True wealth is the ability to breathe freely

without the weight of survival pressing on your chest.

Everything you invest today

is a vote for that peace.

9. A Final Reflection: The Person You’re Becoming

Let me tell you something gently,

as a friend who has walked this journey with you across these chapters:

You are no longer the person who began reading this guide.

You are not the person who feared equity.

You are not the person who relied only on gold and FDs.

You are not the person who chased shortcuts.

You are not the person who panicked during dips.

You are not the person who avoided financial decisions.

You are becoming:

- someone who understands money deeply

- someone who respects their future self

- someone who knows how to build wealth

- someone who makes decisions calmly

- someone who chooses wisdom over impulse

- someone who grows steadily

- someone who is emotionally mature about money

- someone who trusts the long game

This is not just progress.

It is evolution.

And it is beautiful.

10. Your Journey Continues: What To Do After This Article

The path ahead is simple and clear.

Step 1 Choose your portfolio blueprint

(Stability, Balanced, or Growth)

Step 2 Start or adjust your SIPs

(Set them on automation)

Step 3 Build your dashboard

(Track your financial life monthly/quarterly)

Step 4 Rebalance yearly

(Not more, not less)

Step 5 Read deeper, grow deeper

Companion articles that expand this journey:

- The Path to Real Wealth: Why Patience and Compounding Beat Shortcuts

- Why You Keep Chasing Quick Profits

- Financial Anxiety Is the Modern Disease

- Your Financial System Needs a Dashboard — Not Just Dreams

Step 6 Play the long game

Invest with your heart calm

and your horizon wide.

11. Closing Words A Quiet Promise Between You & Your Future

Let’s end with something soft, but powerful:

Imagine your future self

wherever they are:

on a balcony,

in a peaceful home,

with the morning sun warming their face,

free from financial fear,

free from uncertainty,

free from survival mode.

They are smiling.

Not because life is perfect.

But because you showed up for them.

Every SIP.

Every thoughtful decision.

Every moment of patience.

Every refusal to panic.

Every choice to grow.

Every disciplined month.

Every emotionally mature step.

You gave them a life they can breathe in.

A life they can enjoy.

A life without fear.

A life built with intention.

And that…

that is the greatest gift anyone can give themselves.

If you’ve read this till the end, thank you❤️

With love,

Your Dearest Friend,

Chitraansh