A Systematic Investment Plan (SIP) is one of the kindest habits you can build for your future. It is small, disciplined, and does not demand heroics. Yet, over time, the quiet repetition of putting money away this way compounds into real freedom: less worry about emergencies, clearer progress toward dreams, and the confidence that money is working with you, not against you.

This article is a practical 12-month plan that teaches you why SIPs work, how they work, and what to actually do every month. By the end you will have a complete roadmap and the clarity to build a lasting habit.

Understanding SIP: Simple Definition and Power Features

A SIP is a small, fixed amount you invest regularly (usually monthly) into an investment vehicle typically mutual funds. You choose an amount that fits your life, schedule an automatic transfer, and let the market and compound interest do the rest. The two most powerful features are:

- Discipline through automation you build savings by default, not by willpower alone.

- Rupee cost averaging you buy more units when prices are low, fewer when prices are high, smoothing the effect of market moves.

Think of a SIP as a money habit rather than a one time decision. Habits are built by frequency and simplicity, not by grand gestures.

The Psychology of SIP: Overcoming Mental Roadblocks

Money habits rarely fail because of numbers. They fail because of feelings the subtle emotional storms beneath the surface: fear, fatigue, pride, uncertainty. You can learn every formula in finance, but if you do not understand the mind behind the math, the habit will not last.

Below are five quiet psychological forces that shape how we handle SIPs and how to work with them.

Overcome Present Bias: The “I’ll Start Next Month” Trap

You have probably felt this: payday arrives, and your mind whispers, I will invest after this weekend there is a dinner, a sale, a bill… Days pass, and suddenly the month is gone. That is not failure that is biology.

Our brains are built to value immediate comfort over distant security. The reward of buying now is visible. The reward of saving is invisible.

Antidote: Automate it before your brain has a chance to negotiate. When your SIP goes out automatically, the choice disappears and with it, the mental tug of war. Over time, your brain starts to normalize that debit as routine, not sacrifice. This rewires your emotional reward system saving starts to feel as natural as spending.

Managing Loss Aversion and Market Fear in SIPs

Nothing disturbs peace like seeing your investment dip in value. We are wired to feel the pain of losing ₹1 twice as hard as the joy of gaining ₹1. So when markets fall, panic often looks like I will stop for now.

Antidote: Reframe losses as discounted opportunities. SIPs are built for turbulence they buy more when prices fall. Write a short personal rule, even if it is a line in your notes app: I will continue my SIPs for at least 12 months and review quarterly. That written boundary protects you when emotion clouds logic.

Over time, you will notice a deeper calm the kind that comes not from control, but from clarity.

Beat Decision Fatigue: Simple Fund Selection

We tell ourselves we will start after researching the best SIP. Weeks pass in endless comparisons. This is called decision fatigue when too many good options paralyze us into doing nothing.

Antidote: Simplify to the edge of boredom. Pick one or two trusted funds an index fund and one balanced fund are enough to start. Later, once the habit is automatic, you can optimize. Think of this like learning to walk before running you do not need perfect shoes to take your first step.

Financial Peace: Anchor Goals to Your Values

Modern life makes comparison effortless. Someone posts about a new car, another about crypto gains and suddenly your steady SIP feels small. This is how insecurity grows quietly into financial impulsivity.

Antidote: Anchor your money goals to your values, not to visibility. Write down why you invest security, peace, freedom, family. Keep a private tracker that shows your growth, not the market is. Progress measured privately is far more satisfying than success performed publicly.

Making SIP Progress Visible and Rewarding

In the early months, SIPs feel invisible. You invest ₹5,000, see ₹5,030, and wonder, What is the point? But you are missing what is quietly happening: consistency is building momentum, and momentum compounds.

Antidote: Make progress visible. Track your cumulative investment, not just returns. Even seeing the total invested climb creates pride. The mind needs visible proof of progress to stay engaged.

Over time, those small green numbers on your tracker become emotional evidence: I am actually doing this.

The Core Math of SIPs: Formulas and Compounding Power

You do not need to be a mathematician. But knowing a couple of formulas and examples will remove fear and make decisions confident.

Calculating SIP Future Value (FV)

If you invest a fixed amount P every month for n months and expect a monthly return r (decimal), the future value (FV) after n months is:

FV = P × [ ( (1 + r)^n − 1 ) / r ]

P= monthly SIP (e.g., ₹5,000)r= expected monthly return (annual return ÷ 12). If annual expected return is 12% → r = 0.12 / 12 = 0.01n= number of months

This formula assumes you invest at the end of each month (standard SIP).

Example 1 — 12 months, ₹5,000 monthly, 12% annual (1% monthly):

Calculate 1.01^12 ≈ 1.126824.

(1.126824 − 1)/0.01 = 12.6824.

Multiply by ₹5,000 → FV ≈ ₹63,412.

So in one year, ₹60,000 invested ($12 \times ₹5,000$) grows to about ₹63,412 at 12% p.a. The difference is the market return small but meaningful, and the real power comes from compounding across years.

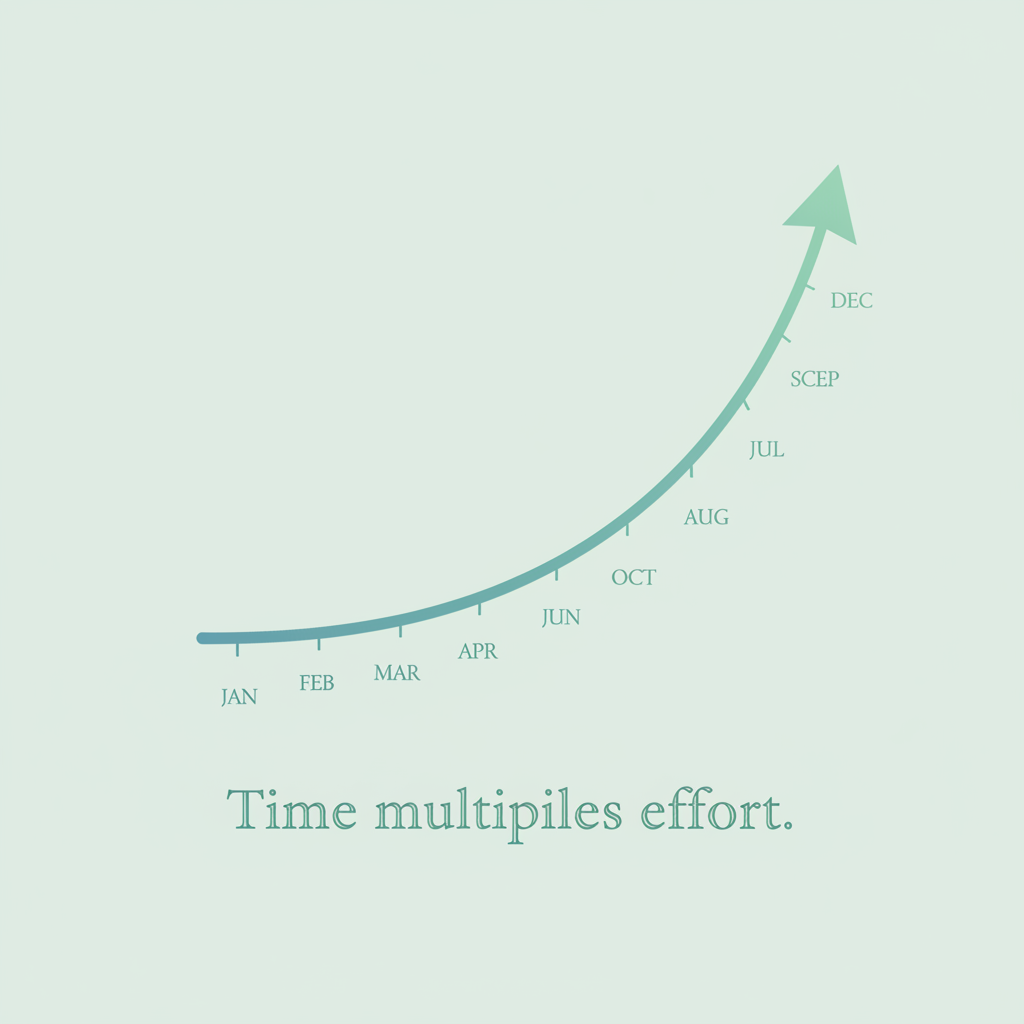

The Power of Time: Why Consistency Beats Timing

Compound interest grows faster with time. If you keep investing the same amount over many years, the later years (when the corpus is larger) add disproportionate value.

Compare two simple cases (conceptual):

Investing ₹5,000 monthly for 5 years then stopping vs. investing the same ₹5,000 monthly continuously for 10 years the 10 year continuous plan yields far more than double because the early investments keep compounding longer.

Progressive Investing: The 10% Annual Increase Rule

A simple tactic: every year increase your SIP by 10% (or when you get a raise). This small rate keeps your habit progressive and fights inflation.

Simple projection: If you start at ₹5,000 and increase by 10% each year, Year 2 SIP = ₹5,500, Year 3 = ₹6,050, etc. Over many years, this materially boosts the corpus without large one time sacrifices.

Your 12-Month Month-by-Month SIP Action Plan

This is the heart of the article. Twelve practical months with exact actions, mindset work, and what to expect.

The Gentle Decision (Before Starting)

Goal: Decide to start. Pick a small, non terrifying SIP amount.

Actions:

- Choose a target SIP amount that will not make your life hard. For many beginners: ₹1,000 ₹5,000 is perfect. The right amount is the one you can keep without stress.

- Decide which fund(s) you will use. For most beginners: 1) an equity index fund or large cap fund, and optionally 2) a debt fund if you want lower volatility.

- Set up an automatic bank mandate or UPI auto pay for the SIP date you prefer (e.g., 1st or 10th of every month).

- Write a 12 month commitment note: I will invest ₹X on the Yth for the next 12 months and review every 3 months.

Psychology: Make the decision small and binding. Signing a commitment note (even a typed one) increases follow through.

Month 1: Start and Observe

Goal: Make the first payment. Pay attention, not panic.

Actions:

- Let the first SIP run. Save a screenshot or PDF of the confirmation.

- Note how you feel 24 hours after it goes out. You might feel little to no pain that is a useful insight.

Psychology: The first action breaks the mental inertia. Your brain is wired to resist anything new, especially when it involves money leaving your account. But once the SIP is done, the fear fades faster than expected proof that the real obstacle was anticipation, not the act itself. The first SIP isn’t about profit, it’s about learning why chasing quick profits rarely works (Why You Keep Chasing Quick Profits). Rewarding yourself with a small, peaceful treat builds a positive emotional link to the act of saving.

Month 2: Build the Tiny Ritual

Goal: Add a ritual to reinforce the habit.

Actions:

- After your SIP confirmation arrives, update a tracker (Google Sheet or notebook).

- Set a visual cue: a sticky note on your fridge or phone wallpaper that says We saved today.

Psychology: Your mind craves closure tracking gives that. When you see your progress, the brain releases a small dose of dopamine, the same chemical that fuels social media scrolling. You are hijacking that same loop but for your benefit. Rituals turn effort into rhythm. Just like brushing your teeth, your mind begins to crave the stability. This is how consistency quietly beats shortcuts (The Path to Real Wealth).

Month 3: Learn One Concept Clearly

Goal: Understand rupee cost averaging and volatility.

Actions:

- Read one short explainer on how SIPs buy more units when prices fall.

- Review past fund charts not to predict, but to understand movement.

Psychology: Fear thrives in the unknown. When you understand volatility, the brain replaces panic with pattern recognition. You will start noticing dips as buying opportunities instead of threats. This simple mental shift turns market fear into market patience. The more you understand movement, the less emotional your money decisions become, which is a foundation for overcoming financial anxiety (Financial Anxiety Is the Modern Disease: How to Heal Money Fear & Stress).

Month 4: Check In, Don’t Tinker

Goal: Observe, do not interfere.

Actions:

- Review tracker. Note invested vs. current value.

- Ask: Has my financial situation changed materially? If not, do nothing.

Psychology: When you start investing, small ups and downs feel personal like the market is testing you. But your emotional brain is built for short term survival, not long term compounding. Setting a clear review rule tricks your brain into delegating decisions to the logical side. The real progress here is not financial it is emotional maturity. You’re learning why doing less can actually earn more (The Hidden Cost of Constant Hustle: Why Doing Less Earns More)

Month 5: Add a Simple Goal

Goal: Link SIP to a real life purpose.

Actions:

- Label your SIP (Emergency Cushion or Travel 2027).

- One goal per fund keep it clean.

Psychology: Saving without purpose feels like sacrifice. But when every rupee has a face of a vacation, peace of mind, or safety the act stops feeling like loss. Emotionally, you are no longer giving up money; you are transferring it to your future self. This clarity is part of redefining real progress in life (How to Measure Real Progress in Life (When Money Isn’t Enough).

Month 6: Review and Small Raise

Goal: Celebrate 6 months. Adjust only if ready.

Actions:

- Review progress.

- If you can, raise SIP by 5 10%; if not, keep steady.

Psychology: At this stage, many people quit not because it is hard, but because it feels routine. Celebrating progress reactivates motivation. The small increase is not about the amount it is about proving to yourself, I can handle growth. The brain loves progress more than perfection. You’ve built a system, not just a habit — much like creating your own financial dashboard (Your Financial System Needs a Dashboard — Not Just Dreams).

Month 7: Build Your Emergency Cushion

Goal: Create safety to protect the habit.

Actions:

- Build a small emergency fund (₹5,000 ₹20,000).

- Keep it accessible, not invested.

Psychology: Fear of what if silently kills good habits. A safety cushion tells your brain, We are safe. That sense of control lowers anxiety and keeps your SIPs alive during chaos. This month is about emotional insurance, not financial returns. When you know you can handle emergencies, you stop fearing volatility and start thinking long-term. That’s how emotional balance meets financial clarity (Emotional Spending Psychology).

Month 8: Revisit Allocation

Goal: Match your money is purpose to your time frame.

Actions:

- Classify each SIP: short term (<3 yrs) or long term (5+ yrs).

- Adjust only if your goals changed.

Psychology: People panic when they see losses on money they need soon. By matching time horizon to risk, you reduce that emotional mismatch. You are aligning your portfolio not just with logic but with your future emotions.

Month 9: Automate the Nudge

Goal: Prepare your future self to do the right thing easily.

Actions:

- Set a calendar reminder or standing instruction for a future SIP increase.

Psychology: Your present self loves comfort. Your future self loves progress. Automation bridges that gap. When you pre commit, you remove the need for willpower later because the decision is already made. It is a way of protecting your best intentions from your future moods, a small step toward turning patience into power (The Path to Real Wealth).

Month 10: Learn About Costs and Taxes (Lightly)

Goal: Understand basics without drowning in details.

Actions:

- Check fund expense ratios.

- Know that taxes exist; do not obsess.

Psychology: Ignorance creates anxiety; over information creates paralysis. A little knowledge calms your mind and helps you trust the process. This month is about finding that balance learning enough to feel in control, not enough to freeze.

Month 11: Rebalance Mentally

Goal: Stay steady through noise.

Actions:

- Plan a rebalance rule (once a year or 10% deviation).

- Avoid reacting to headlines.

Psychology: Every news cycle triggers fear or greed. But rules anchor you to reason. By deciding your boundaries in advance, you remove the emotional chaos of should I sell? the question that ruins most investors. You are training emotional discipline, not just portfolio balance.

Month 12: Celebrate, Reflect, and Plan Next Year

Goal: Look back with pride. Look forward with clarity.

Actions:

- Calculate total invested and value.

- Write a short note to your future self.

- Decide plan for next year.

Psychology: Reflection activates gratitude a powerful emotional state that sustains long term habits. By celebrating discipline over returns, you detach from outcome obsession and anchor yourself in consistency. Writing to your future self transforms your financial plan into a personal story one that keeps unfolding.

Now you’re ready to explore the best investment options for 2025 (Best Investment Options in India for 2025) not from fear or FOMO, but from a place of calm clarity.

Practical SIP Setup: Choosing Funds, Dates, and Amount

Choosing Funds (Keep it Simple)

Start with at most two choices:

- Equity index fund (or large cap index) low cost, reliable for long term growth.

- Debt/liquid fund for short goals or emergency buffer.

If you want active management, pick one well reviewed active large cap or multi cap fund, but keep cost and track record in mind. For a beginner, an index fund + a liquid fund is a clean, effective pair.

SIP Date

Pick a date you expect salary or cash availability e.g., within a week of payday so the money is there. Automate it.

Starting Amount

Start small and consistent. Better to start ₹1,000 and never stop than ₹20,000 and quit after 2 months.

Realistic SIP Expectations: Short-Term Risk vs. Long-Term Power

- Short term (1 year): Market returns can swing widely; expect noise. Do not make decisions based on short term movements.

- Medium term (3 5 years): SIPs start showing more meaningful compounding, but still require patience.

- Long term (10+ years): SIPs are powerful. Time and regular investing are your greatest advantages.

Reality check: SIPs do not guarantee high returns every year, but they dramatically increase the probability of building wealth sensibly over long time horizons.

Debunking Common SIP Fears and Anxieties (FAQ)

Fear: What if the market crashes?

Answer: SIPs actually use downturns to your advantage by buying more units at lower prices. Maintain an emergency fund so you do not need to liquidate investments during a crash.

Fear: I do not have enough money.

Answer: Start with what you have. Even ₹500 or ₹1,000 per month builds the muscle of saving. Increase the SIP later.

Fear: I will miss out on picking the best fund.

Answer: Choice paralysis is the enemy. Good enough, started early, beats perfect and delayed. Index funds are a safe default for beginners.

Fear: I will forget.

Answer: Automate and build a ritual. A single small habit is easier to maintain than many decisions.

Real-Life SIP Starter Plans (Example A & B)

Both plans emphasize start small, be consistent, and align risk with horizon.

Example A Young Starter (age 25, long horizon)

Goal: Retirement / long term wealth

SIP: ₹3,000/month into an equity index fund

Expectation: Consistent investment for many years. Increase SIP by 10% annually.

Example B Safer Starter (age 35, mixed goals)

Goal 1: Emergency cushion (short term)

Action: Put ₹10,000 in a liquid fund or savings account first.

SIP: ₹5,000/month split ₹3,500 into equity fund, ₹1,500 into debt fund (for medium term stability).

Monitoring SIP Progress: Quarterly and Annual Reviews

Set a monitoring habit that protects you from two temptations: constant tinkering, and neglect.

- Quarterly check: Look at the amount invested and progress toward goals. Ask: is my life situation changed? If yes, adapt.

- Annual review: Rebalance, increase SIP if possible, rewrite goals for next year.

- Never check daily or hourly: Short term price moves cause emotional decisions.

Proven Behavioral Tricks for SIP Habit Sticking

- If then plan: If I get a salary raise, then I will increase SIP by 10%. Concrete plans beat vague intentions.

- Public commitment: Tell one trusted friend; social accountability raises follow through.

- Visual progress: Use a chart or an app that shows the cumulative invested vs. market value. Seeing the line move helps enormously.

- Micro rewards: Celebrate every 6 month milestone with a small treat.

- Habit stacking: Attach SIP ritual to an existing habit e.g., after paying rent, check your SIP confirmation.

Top Mistakes to Avoid When Starting a SIP

- Trying to time the market. SIPs remove the need.

- Overcomplicating the portfolio. Too many funds = confusion. Start with one or two.

- Stopping SIP during volatility out of fear. This destroys the benefit of rupee cost averaging.

- Not having an emergency buffer. This is the most common reason for abandoning SIPs.

- Chasing past returns. Past performance is not a promise. Focus on process.

Next Steps: Advanced SIP Strategies for Growth

Once you are comfortable, consider these:

- SIP top ups: Move bonuses or windfalls into SIPs rather than big purchases.

- Goal buckets: Add separate SIPs for different goals (vacation, home down payment, retirement).

- Dynamic increases: Link SIP increases to salary inflation, not emotional market moves.

- Tax efficient planning: When ready, consult a tax professional for tax optimized fund choices (keep in mind tax laws change).

The Emotional Toolkit: Staying Steady Through Market Noise

Your inner narrative matters. Here are a few lines you can say to yourself when doubt rises:

- This is a long road. My small steps matter more than market noise.

- My SIPs buy opportunity when prices are lower.

- I built a cushion. I can handle surprises without stopping savings.

- I will check outcomes on my schedule, not the market is.

Write these in your notebook or put them as a wallpaper. When markets get loud, your inner script should be louder and calmer.

Quick Start SIP Template: Copy and Implement

- Decide SIP start date (e.g., 10th of next month).

- Choose SIP amount (₹X) you can maintain for 12 months.

- Pick one fund: equity index fund (if horizon 5+ years) or debt fund (if <3 years).

- Set up auto debit/mandate. Take screenshot of confirmation.

- Start a tracking sheet with: Date, Amount invested, Cumulative invested, Current value, Notes.

- Set calendar reminders: Quarterly check (3 months), Annual review (12 months).

- Reward yourself after month 6 and month 12.

Quick SIP FAQ: Answers to Your Top Questions

Q: How much should I start with?

A: Something you will not miss ₹1,000 to ₹5,000 monthly is a useful starting range for many beginners.

Q: What if I miss an SIP?

A: Do not panic. Continue next month. Try to set the date near payday to reduce misses.

Q: Should I pause SIP during a crash?

A: No market dips are precisely when SIPs are most beneficial. Pause only if you must for a real emergency.

Q: How long before I see results?

A: Habit wise: you will feel confident after 3 6 months. Financially: real compounding benefits become clearer in 3 5+ years.

Q: What about taxes?

A: Taxes vary by fund type and rules change. Check current tax laws or consult a tax advisor.

Psychological Exercises to Reinforce Your SIP Habit

Exercise 1 The 2 Minute Reflection

Once a month, spend exactly 2 minutes writing: This month I invested ₹X. I felt ___ about it. One small change I can do next month is ___. Keep it short and non judgmental.

Exercise 2 The Future Letter

Write a one page letter to yourself 5 years from now. Describe what life looks like if you keep the SIP habit. Read this letter every 6 months.

Exercise 3 The Immediate Anchor

When the SIP mandate hits, do a single intentional breath and say We invested. This short ritual reinforces identity: I am a person who invests.

The Gentle Truth: Realistic SIP Expectations

SIPs are not a shortcut to instant riches. They are the systematic practice that, over time, becomes your financial backbone. The first year is more about forming the habit than building a huge corpus. Be kind to yourself if returns are modest or if you occasionally slip. What matters is that you build a steady, resilient process.

Final Takeaway: Consistency is Your Greatest Financial Skill

You do not need courage every day. You need a system that makes good decisions automatic and a mindset that lets you keep going when the world gets noisy.

Key actionable lessons (crisp):

- Start small, automate, and stick to 12 months as your first commitment.

- Build a tiny emergency buffer before you panic during volatility.

- Learn the basics (rupee cost averaging, time horizon) but do not overlearn.

- Increase SIPs gradually (5 – 10% yearly or on raises).

- Monitor quarterly and celebrate every milestone.

The most important financial skill is not picking the perfect fund it is building the discipline to invest consistently. SIPs let you practice that discipline one calm, monthly step at a time.